To build connection and capacity for social sector leaders in equitable, collaborative data practice, Data for Social Impact (DSI), an initiative of the Social Policy Institute at Washington University in St. Louis, launched a Data Equity learning cohort in January 2024 in collaboration with Actionable Intelligence for Social Policy (AISP) of the University of Pennsylvania. […]

Category: Blog

For blogs

Participatory Research for Guaranteed Income: In Her Hands

By Katie Ragsdale, Katie Kristensen, Dr. Leah Hamilton, and Dr. Latrice Rollins The Social Policy Institute (SPI) seeks to shift to a participatory approach throughout its research and programming. Our working definition of a participatory approach draws on the theory and practice of Community-Based Participatory Research (CBPR). While CBPR is not always feasible or appropriate […]

Fostering Inclusive Policy Research: Embracing a Participatory Approach

By Katie Ragsdale & Katie Kristensen At the Social Policy Institute (SPI), we are deeply committed to fostering inclusive and impactful policy research. We recognize that the traditional top-down approach to policymaking often neglects the voices and experiences of communities and stakeholders most impacted by the problem at hand. Over the past two years, we […]

Tackling Disparities in Child Education Amidst COVID-19 Recovery: Lessons from Israel

Yung Chun, Oren Heller, Jason Jabbari, Yaniv Shlomo, Ayala Hendin, Fanice Thomas and Michal Grinstein-Weiss The COVID-19 pandemic made significant and wide-ranging impacts on child education by disrupting learning process and exacerbating existing inequalities across continents. School closures intended to curb the virus’s spread, resulted in reduced instructional time and limited access to crucial resources […]

Free Online Course Focuses on Cultivating Collaborative and Equitable Data Practices

Data for Social Impact, an initiative of the Social Policy Institute at Washington University in St. Louis, has launched a free online course for social sector professionals. While many courses develop technical data skills, this course—designed with, by, and for social sector leaders—supports organizations in cultivating equitable, collaborative data practices. Each module includes worksheets, resource […]

Data for Social Impact Summit [Five Key Takeaways]

In November 2022, the Social Policy Institute at Washington University in St. Louis hosted Data is for Everyone: A Data for Social Impact Summit. The summit’s goal was to build connection and capacity among social sector organizations to cultivate equitable, community-centered data practices. The event featured 21 local and national speakers across five panels. Each […]

Changes in food insecurity levels during the COVID-19 economic crisis: Differences based on sociodemographic factors

By Oren Heller, research director, Israel; Yaniv Shlomo, Data Analyst, Israel; Hayley Kalb, communications assistant; Michal Grinstein-Weiss, founding director Food insecurity is a national problem with short and long-term consequences that harm the economy and society. This problem was exacerbated by the COVID-19 pandemic, as the labor market changed, affecting the disposable income of many […]

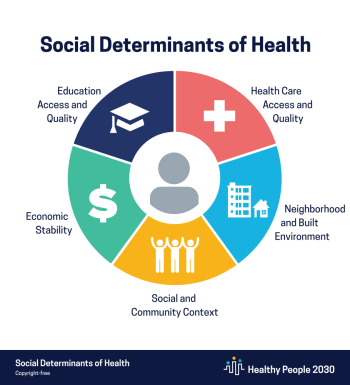

5 Ways Public Health Keeps Communities Healthy (Links to an external site)

Tyler Frank, doctoral research assistant, published this blog on GoodRX Health discussing how public health helps promote social justice, equity, and collective action, and how it keeps communities safe.

Improving perinatal outcomes for mother and child through Fresh Rx: Nourishing Health Starts

Dan Ferris, associate director of education and training for SPI, along with co-authors, recently published, “Does a food insecurity intervention improve perinatal outcomes for mother and child? A randomized control study protocol of the Fresh Rx: Nourishing Healthy Starts program,” in the Journal of Public Health Research.

Lessons from a global team

I truly believe we can accomplish more by stepping outside of our own culture and seek to understand and learn from each other. This is what makes SPI’s global approach to its work so impactful. I look forward to hosting WashU colleagues in Israel next time.

Human-centered approach to benefits research for health care field

By Kourtney Gilbert, program coordinator, SPI As researchers, we work a lot with numbers on a page. These numbers often feel distant from the people they represent, or the policy and practices we hope to inform. For this reason, when the Social Policy Institute launched its Building on Benefits research project aimed at better understanding […]

How do health care costs impact household finances and access to care?

Prioritizing affordability of care will be the first step to ensuring that a healthy life is feasible for everyone regardless of finances.

Household Financial Security: What can we learn from research in the U.K.?

A Trans-Atlantic Policy Forum could bring together academic researchers,

policy makers, advocates, and corporate leaders in the U.S. and U.K. to develop

insights to fuel changes in public policies and corporate behavior to promote the

financial security of low- and moderate-income (LMI) individuals and families.

New Year greetings from the director

Thank you for being a valued member of the Social Policy Institute community this past year. I am extremely proud of our team—staff, faculty affiliates, funders and community partners—who work so hard to make the world more equitable for everyone. Our mission to make the world more equitable by applying innovative, evidence-based solutions to complex social problems […]

15 Actionable Strategies to Embrace Inclusive Leadership

Speakers at the Inclusive Growth in St. Louis event series on Sept. 23 identified 15 strategies to proactively support and amplify diverse voices and perspectives as discussed by the speakers at the event.

Promoting Childhood Vaccination During the COVID-19 Pandemic

As schools start back up, many parents are concerned about the health effects of COVID-19 in children. However, childhood diseases beyond COVID-19 are still threats to children’s well-being. In the early stages of the pandemic, there was a large decrease in childhood vaccination rates for diseases such as diphtheria, pertussis, measles and mumps.

Improving Access and Minimizing Obstacles for Medicaid Buy-In Participation

Medicaid Buy-In (MBI) has received public and policymaker attention in recent years as an option for states to expand access to healthcare. “Eligibility can be so confusing and complicated it presents an obstacle for providers and government alike to communicate clearly, never mind promote Medicaid buy-in for working people with disabilities.” Kimberly Lackey, Director of […]

Does one size fit all? Exploring provider behavior interventions and best practices alignment to improve healthcare for all

The COVID-19 pandemic has forced the United States to reassess public health as we know it. In a time where providers were forced to wear trash bags as personal protective gear and alarming ICU rates across the nation, it is clear we are witnessing a shift in the future of healthcare services. But to what […]

Food assistance (SNAP) recipients were disproportionately forced out by landlords during the pandemic

Previous analysis of the Social Policy Institute’s Socioeconomic Impacts of COVID-19 Survey found that Temporary Aid for Needy Families (TANF) recipients were evicted at higher rates than households not getting TANF, and new analysis finds similar trends for households receiving Supplemental Nutrition Assistance Program (SNAP) funds.

Cash assistance (TANF) recipients suffer the brunt of evictions despite the moratorium

New evidence from the Social Policy Institute’s multi-wave Socioeconomic Impacts of COVID-19 Survey shows that during the pandemic, TANF recipients were evicted at significantly higher rates than non-recipients, even when accounting for differences in demographics, income, assets, recent job loss, and how many months behind they are in rental payments.

COVID-19 School Meal Policies as Long-term Strategies to Fight Child Food Insecurity

In response to COVID-19 and the nationwide school closures that followed, the federal government passed the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Through these policies, the USDA was able to grant meal waivers to help schools and community organizations provide meals and snacks during COVID-related […]

The Babies in the River: Creating Equitable Safety Nets and Springboards to Opportunity

by Nisha G. Patel, Senior Fellow, SPI Some 25 years ago, I was a bright-eyed, young, graduate student at the Brown School and I learned the parable of the babies in the river. The townspeople in a village noticed that babies were beginning to appear in a river and were in danger of getting swept away by the current. Some people immediately jumped into the river, scooping up the babies to save them from drowning. […]

Fee payments to access COVID-19 relief funds threaten household financial security and economic recovery

The U.S. Senate signaled that it has the votes to pass a new $1.9 trillion stimulus through the budget reconciliation process on February 2, 2020. This means that a new round of COVID-19 relief payments is likely. These relief payments, which propose distributing $1,400 to qualifying adults, will be the third such payment offered since […]

A Message from the Director

As we are opening a near year, we are also experiencing the tragedy of the violence at the U.S. Capitol on Jan. 6, 2021. It was a sad day in our nation’s history and highlights the ever-widening divisions within the country. Despite the shocking and unprecedented moment in American history, Congressional leaders were undeterred and […]

School breakfast matters for Missouri students

Guest post by Sarah Ritter, manager of public policy, Operation Food Search Child nutrition programs are essential to ending hunger and supporting children’s health, learning and development. One important yet underutilized program is the School Breakfast Program (SBP). Students who eat breakfast at school consume more fiber, calcium and vitamin C – nutrients all children […]

7 Tips to Mitigate Hoarding Behavior

Mary Acri has seven tips to manage feelings of powerlessness, helplessness and fear without stockpiling toilet paper as the pandemic persists.

A different dialogue: Lifting up community voices

By: Sarah Cowart, communications manager for Social Policy Institute; Pamela Chan, associate director for Social Policy Institute, and Daniel Barker, director of research and knowledge, Mastercard Center for Inclusive Growth If you attended “Building an Inclusive Economy” on October 7 with the Social Policy Institute at Washington University in St. Louis (SPI) and Mastercard Center […]

SPI introduces new program with Brown School for students interested in data and statistics

Data and statistics are foundational to policy research and practice. As Social Policy Institute continues to grow, developing opportunities for people to increase knowledge and skills in these areas is a focus of our organization. One example of how we are doing this is a new opportunity led by the Brown School at Washington University in St. Louis and Social Policy Institute: Data and Statistics for Policy Practice.

Emergency savings are a potential lifeline for households in financial distress due to COVID-19

Many U.S. households have lost a job and/or income due to the COVID-19 pandemic. These types of losses can influence an individual’s level of life satisfaction and thus, their overall health and well-being. One possible strategy to mitigate the impacts of economic volatility for U.S. individuals and households is to build a rainy-day fund. A […]

Hardship is greatest among vulnerable Israelis already struggling financially

By: Olga Kondratjeva, data analyst III, Social Policy Institute; Michal Grinstein-Weiss, director, Social Policy Institute; Talia Schwartz-Tayri, researcher, Ben-Gurion University of the Negev; John Gal, professor, The Paul Baerwald School of Social Work and Social Welfare, The Hebrew University of Jerusalem; senior researcher, the Taub Center for Social Policy Studies in Israel; & Stephen Roll, […]

Safe, affordable child care is a right, not a privilege

As the United States nears the seventh month of weathering COVID-19’s impact, it has become clear that the economy will not recover simply by encouraging businesses to re-open or consumers to keep shopping. Working adults with children are being disproportionately affected by COVID-19 and will continue to struggle without stronger federal and state support for child care.

Gig work can be a lifeline, but it may be disappearing for those that need it

When you think of gig work—types of work where online apps and platforms allow workers to get paid for a range of services including ride-sharing, home repairs, art sales, and property rental—you might imagine a flexible job that enables anyone to earn income. If you have a reliable car and a smartphone, you can download […]

The impact of tax refund delays on the experience of hardship and unsecured debt

The Earned Income Tax Credit (EITC) provides substantial financial support to low-income workers, yet around a quarter of EITC payments are estimated to be erroneous or fraudulent. Beginning in 2017, the Protecting Americans from Tax Hikes Act of 2015 requires the Internal Revenue Service to spend additional time processing early EITC claims, delaying the issuance of tax refunds. Leveraging unique data, we investigate how delayed tax refunds affected the experience of hardship and unsecured debt among EITC recipients. We find that early filers experienced increased food insecurity relative to later filers after the implementation of the refund delay.

Housing Hardships Reach Unprecedented Heights during the COVID-19 Pandemic

SPI research, published on Brookings Institution: Groundbreaking data from a new large-scale, nationally-representative survey of low- and moderate-income (LMI) households administered by the Social Policy Institute at Washington University in St. Louis in April of 2020 suggests that individuals have been facing increased housing hardship such as evictions, delayed rent or mortgage payments, and unexpected utility payments and home repairs during the pandemic.

Messaging matters when it comes to COVID-19 economic impact payments

The way policymakers and financial capability practitioners communicate about the CARES economic impact payments and other current or future payments may help guide households to use these benefits in the way best suited to their financial situation. This is important because while some households may use the CARES payments to pay down debt and other households may be fortunate enough to be able to save their payments, others will need these payments to simply make ends meet.

We don’t need a map to tell us who COVID-19 hits the hardest in St. Louis

We don’t need a map to tell us that policymakers, health officials, corporations, and St. Louis residents themselves must continue to break down economic barriers to create partnerships and solutions that support the most vulnerable in our city – those who were already facing a disproportionate social, financial, and health burden prior to COVID-19 entering their lives.

What tax refunds tell us about how households might use economic impact payments

While economic impact payments are different than a tax refund, we can be fairly confident, based on this research, that in this moment of emergency, payments from CARES Act will be used on essential purchases. It is also possible households will allocate their economic impact payments to clear debt entirely or to make a minimum payment in order to keep some liquid assets in checking or savings.