By: Alejandra Muñoz-Rivera, Research Assistant, SPI

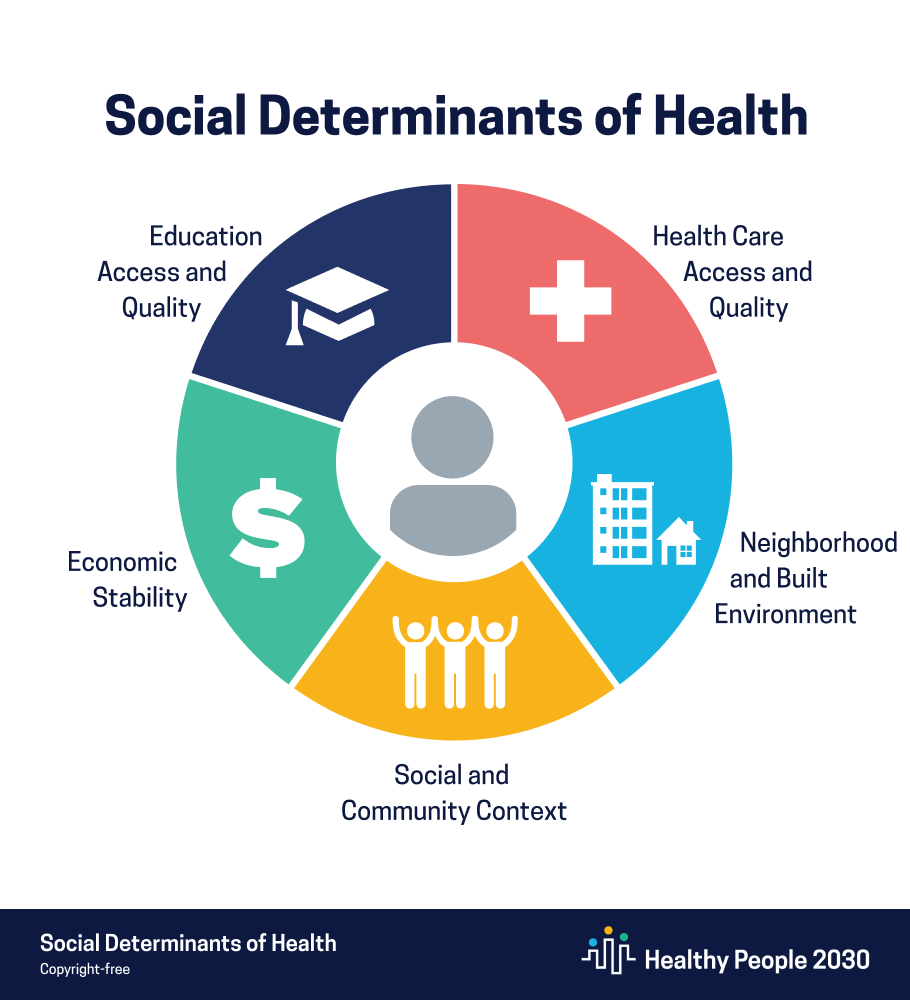

Health is characterized as the summation of a person’s nutrition, physical activity, illness, and wellness of the body. However, there are environmental factors that influence a person’s health outcomes referred to as Social Determinants of Health (SDOH). There are five main domains of social determinants of health: economic stability, education access and quality, health care access and quality, neighborhood and built environment, and social and community context. SPI investigated the intersection of medical debt and the social determinants of health to see how they affect health outcomes.

The intersection of health and wealth

High health care costs play a role in how someone will access care when needed. Someone without financial resources may skip routine care, filling prescriptions, or avoiding emergency care. Here we will explore how the Social Determinants of Health “economic stability” and “health care access and quality” influence each other.

Health care access and quality: A person’s health hinges on ensuring people get timely, high-quality health care service when necessary. Having health insurance allows people to subsidize any out-of-pocket costs for health care allowing people to seek medical attention. However, 1 in 10 people in the US do not have health insurance making those people less likely to seek out regular care. A common barrier for uninsured people to accessing care is cost of care and medication.

Economic stability: A person’s finances can significantly impact decision-making regarding accessing and adhering to health care. Evidence shows that people with consistent employment are less likely to live in poverty and are more likely to be healthy. However, over half of adults between 18 to 64 years of age will experience some form of medical financial hardships.

Difficulty with finances can lead to stress, mental health outcomes, and risky health behaviors such as, smoking and alcohol consumption. Cost barriers to accessing health care services can lead to people not receiving important health information. Even if people can access preventative care, prescription costs may interfere with a patient’s ability to adhere to treatment.

The burden of medical debt

As a result of high health care costs many Americans acquire debt due to an inability to pay for medical bills. In 2020, health care expenditures averaged $12,530 per person, up 9.7% from 2019. In 2018, 19% of U.S. households had medical debt with $2,000 being the median amount owed. Medical financial hardship can include medical bills or debt, stress about medical bills, and delaying or forgoing treatment specifically due to cost. People with medical debt may be forced to take an extra job, borrow money, reduce spending on other essentials to pay for care, or declare bankruptcy.

Medical debt does not affect all individuals equally. Black and Hispanic households are more likely to have medical debt than white, non-Hispanic households. Type of coverage influences medical debt as well. While both Medicaid and Marketplace participants experience debt, 18% of Medicaid recipients report having problems paying medical bills. Furthermore, Marketplace subsidies were associated with 17% lower out-of-pocket spending and 30% lower likelihood of catastrophic health expenditures among low-income adults. Impacts of medical debt can result in having to cut costs in other areas. Those who reported having trouble paying their medical bills indicated cutting costs in other areas, such as avoiding medical care and basic household items.

The role of Medicaid

Medicaid is a government funded entitlement program that provides free or low-cost medical care. The program is funded by both the states and the federal government. Individuals may qualify based on income and family size. Medicaid varies by state, but all states must cover “mandatory” populations:

- children

- low-income parents, caretakers, people who are pregnant, and individuals with disabilities

- seniors who receive assistance through Supplemental Security Income (SSI)

Federal rules require states cover “mandatory” services:

- hospital and physician care

- laboratory and X-ray services

- home health services

- nursing facility services for adults

In 2010, the Affordable Care Act extended coverage, but left states with the choice to expand their programs. Expansion would allow more low-income adults to qualify for Medicaid and lessen the financial burden of health care. As of 2022, 14 states have not expanded their programs.

Potential solutions

“Little p” policies are department or agency policies that influence organizational practices. For example, hospital financial assistance programs are a way of reducing financial burdens associated with health care. These programs are available across hospital ownership types and target low-income patients regardless of insurance status. Financial assistance may come in the form of medical debt forgiveness or reduced out-of-pocket costs and have shown to increase health care utilization after receipt of assistance.

“Big P” policies typically look like government ordinances that need elected officials’ approval. One example that would alleviate the burden of medical debt is expanding health coverage via the Affordable Care Act. Solutions like Medicaid expansion have significant implications. Evidence indicates that Medicaid expansion:

- Increases health care utilization, which results in increased rates of diabetes detection and management and lower rates of depression.

- Decreases financial strain among participants. Medicaid expansion in Oregon saw that catastrophic out of pocket medical expenditures were nearly eliminated.

- Medicaid expansion through the American Rescue Plan Act of 2021 would allot additional tax revenue to the states and lower the state’s matching costs if states were to expand Medicaid.

Affordable medical care can lead to healthier people

Expanded access to affordable medical care will help individuals lead healthier lives and avoid the negative economic impact of seeking medical care. Lessening the financial burden of health care can encourage people to find care before conditions worsen. Increasing health care utilization can lead to early detection of chronic diseases and lessen disease burden through proper management. Furthermore, the COVID-19 pandemic has highlighted the consequences of having health care coverage based on employment. Expanding access to affordable care can ensure continuity of care and help create happier and healthier lives for everyone.

Encouraging both “little p” and “big P” policies that expand access to affordable health care and insurance is imperative to begin ensuring people can find care without worrying about finances. Prioritizing affordability of care will be the first step to ensuring that a healthy life is feasible for everyone regardless of finances.