The U.S. Senate signaled that it has the votes to pass a new $1.9 trillion stimulus through the budget reconciliation process on February 2, 2020. This means that a new round of COVID-19 relief payments is likely. These relief payments, which propose distributing $1,400 to qualifying adults, will be the third such payment offered since the beginning of the pandemic—the first round of payments occurred in the summer of 2020 offering up to $1,200 per adult and the second round of payments were distributed in the winter offering $600.

The intention of these payments is to stimulate spending in the economy and offer a lifeline to households who are struggling to make ends meet. However, the effectiveness of these relief payments depends on households’ ability to get the full amount for which they qualify. New research from the Social Policy Institute at Washington University in St. Louis indicates that this may not be the case for a sizeable minority of households, who reported paying fees to access their first round of relief checks.

Through SPI’s multi-wave Socioeconomic Impacts of COVID-19 Survey, which details the pandemic-related experiences and behaviors of a nationally representative sample of roughly 5,000 respondents, we asked people detailed questions about the Economic Impact Payments (EIPs) they received as part of the March 2020 CARES Act. In the third wave of the survey, administered between November and December, 2020, we asked respondents:

- If they received their EIP;

- How they received the payment;

- If they paid a fee to access their payment; and

- What they used the payment for.

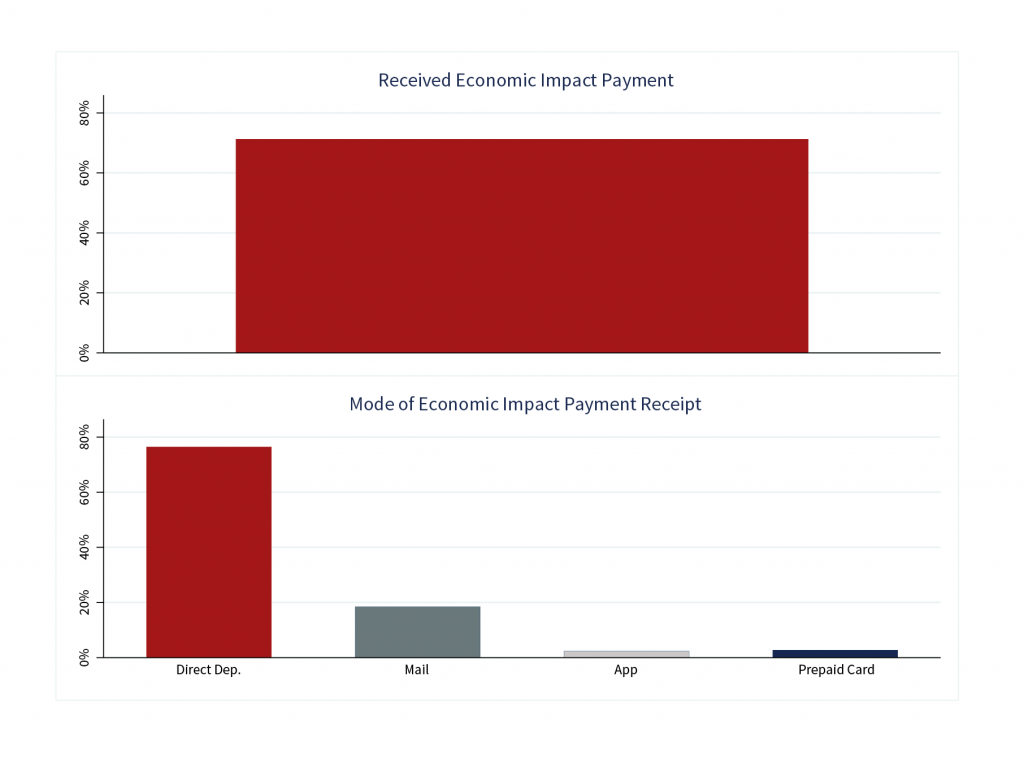

Figure 1. Economic Impact Payment Receipt

N=4,669

Figure 1 demonstrates that by the end of 2020, roughly 75% of respondents had received an EIP. Of these respondents, the vast majority received their EIP through a direct deposit into a bank account, while roughly one in five received it via paper check and small percentages received it via an app or a pre-paid card. Concerningly, Figure 2 shows that 9% of recipients reported paying a fee to access their EIP—a percentage which, when extrapolated to the full population who received EIPs, translates to millions of people paying at least some money to access their relief payment.

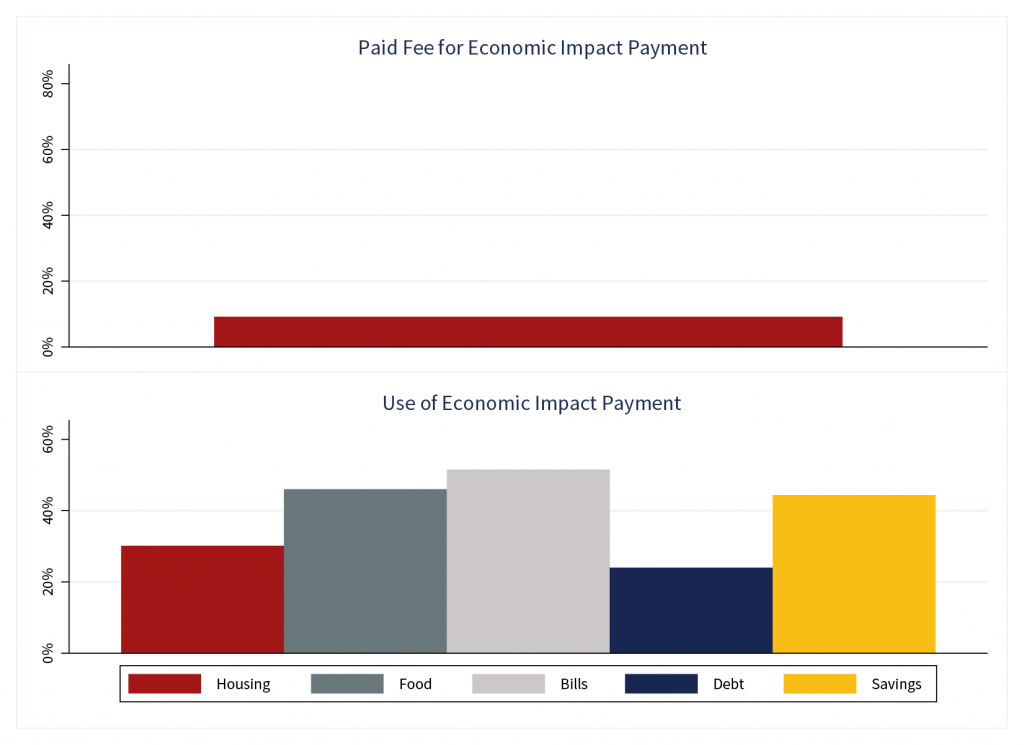

The risk of these fees becomes apparent when examining how households report using their EIP. In the graph at the bottom of Figure 2, we see that large percentages of respondents report using their EIP to cover essentials like housing, food and bills, meaning that EIP fees are likely eating into their ability to pay for these basic needs.

Figure 2. Economic Impact Payment Fees and Usage

Source: Socioeconomic Impacts of COVID-19 Survey, Wave 3 (Nov. 9 – Dec. 11, 2020)

N=4,669

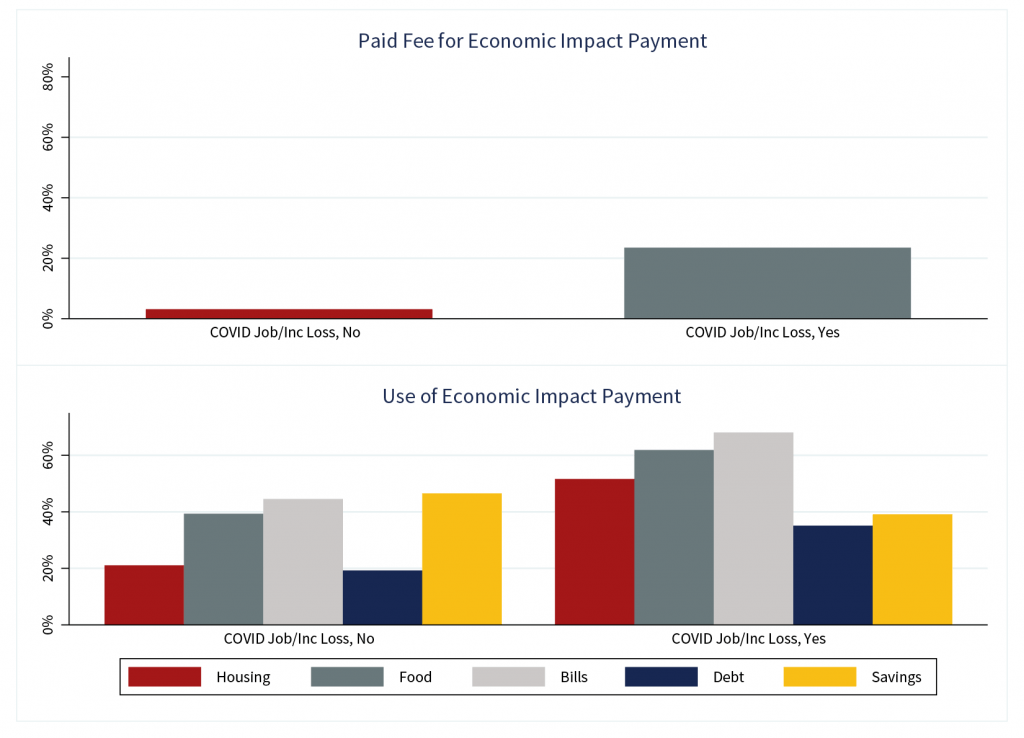

Additionally, these fees appear to be concentrated in households that are most exposed to the economic crisis caused by COVID-19. Figure 3 highlights the same questions as Figure 2, but breaks them out based on whether respondents reported that anyone in their household experienced a job or income loss due to the pandemic. Here, we see that 24% of respondents who reported that someone in their household lost a job or income due to COVID-19 paid a fee to access their EIP, as compared to just 3% of those who did not report a COVID-19-related job or income loss. Compounding this disparity is the fact that the respondents impacted by COVID-19 job/income loss were also much more likely to report using their EIP for basic needs, indicating that EIP fees are concentrated in those households that can least afford them.

Figure 3. Economic Impact Payment Receipt, Use, and Fees Paid, by COVID-19-Related Job/Income Loss

N=4,667

Where are these fees coming from? They could be check cashing fees or banks taking some of the funds to offset unpaid balances (e.g., accounts in overdraft). There may also be fees for accessing the funds through a financial app. For example, though the fee terms for common apps like Venmo and Paypal advertise free access to stimulus payments, the terms of conditions of these offers indicate that only the first $400,000 in deposits qualify.

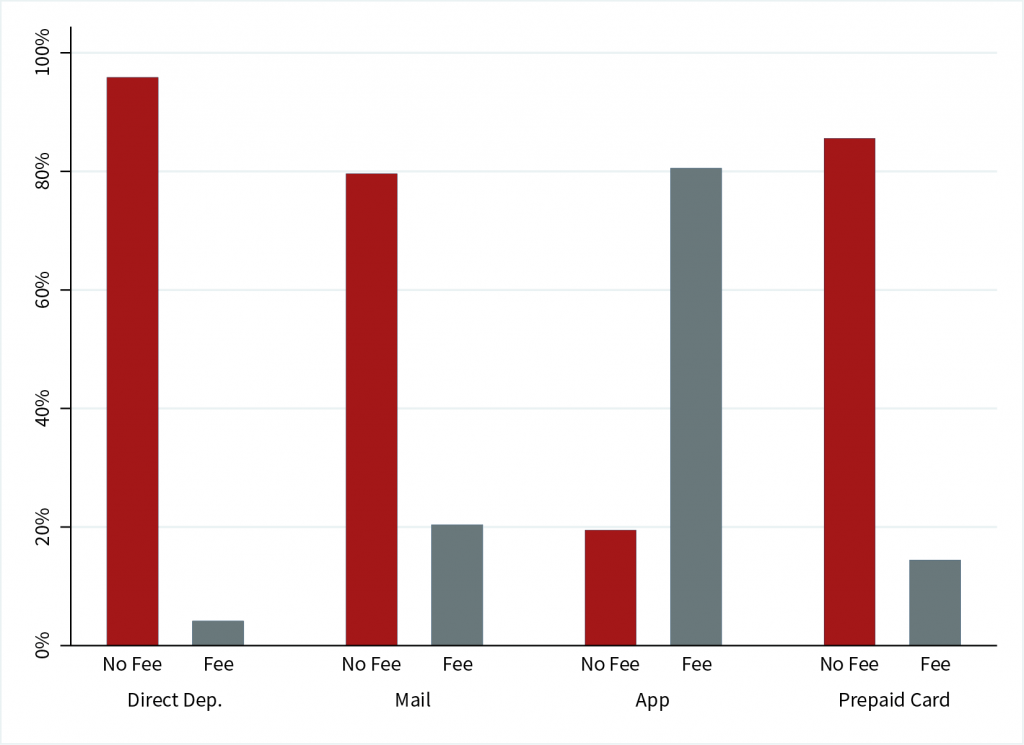

Though the Socioeconomic Impacts of COVID-19 Survey does not ask respondents about what type of fees were paid, the data do help illuminate the potential sources of the problem. Figure 4 examines the relationship between fee payment and the way in which respondents received their EIP, and two primary findings emerge from this analysis.

- First, EIP fee payments were concentrated among households who received their EIP through the mail (20%) or through a financial app (81%). The fee payment rates for app users is striking, as they indicate that the vast majority of people who used an app to receive their EIP paid some sort of fee to do so. However, the fact that a fifth of those who received the EIP through the mail reported paying a fee also indicates that check cashing services may be a primary source of these fees.

- Second, while only 4% of respondents who received the EIP through direct deposit paid a fee, the fact that this was by far the most common means of receiving the EIP indicates that millions of EIP recipients in the U.S. likely paid some sort of fee (or garnishment) when their EIP was directly deposited into their account.

Figure 4. Economic Impact Payment Fees Paid, by Mode of Receiving Payment

N=3,306 who received the EIP

In summary, these findings show that many people are at risk of losing some of their relief payments to fees and that these fees are concentrated among those who can least afford them. Though these results concern the $1,200 relief payments delivered in the summer of 2020, the findings likely translate to the proposed $1,400 payments that may be delivered in the coming weeks or months. These fees pose a risk to both individual households who are financially vulnerable as a result of the pandemic, as well as to the economic stimulus as a whole—smaller relief payments to households will translate to fewer dollars circulating in the economy. Policymakers and regulators should work quickly to identify the sources of these fees and take action to minimize or eliminate them.