We’re thrilled to announce and welcome a new group of emerging leaders in policy research and translation to the JPMC Social Policy Research Scholars Program! This initiative, now in its second year, supports doctoral students from historically marginalized groups underrepresented in academia in their efforts to create a more inclusive, socially, racially, and economically just […]

Category: SPI

St. Louis Social Sector Leaders Discuss Data Equity at STL DataFest 2024

What is the role of data in improving impact? And why is this a matter of equity? St. Louis social sector leaders addressed these questions in a panel discussion at STL DataFest 2024 titled Power in Numbers: How Data for Social Impact Cultivates Inclusive Growth on Friday, May 17. The panel was moderated by Simon Huang, Chief Technology Officer for […]

Data for Social Impact Initiative Launches Data Equity Learning Cohort

To build connection and capacity for social sector leaders in equitable, collaborative data practice, Data for Social Impact (DSI), an initiative of the Social Policy Institute at Washington University in St. Louis, launched a Data Equity learning cohort in January 2024 in collaboration with Actionable Intelligence for Social Policy (AISP) of the University of Pennsylvania. […]

STEM training, apprenticeships increase work satisfaction (Links to an external site)

Participation in a science, technology, engineering and math (STEM) apprenticeship program increased job happiness, finds a new study from the Brown School at Washington University in St. Louis.

SPI sessions at the 2023 Association for Public Policy Analysis and Management (APPAM) Conference

Four Social Policy Institute researchers presented their papers and hosted discussions at the Association for Public Policy Analysis and Management (APPAM) conference from November 9-11, 2023. Below are the papers and discussions presented by the SPI team. Thursday, November 9, 2023 Friday, November 10, 2023 Saturday, November 11, 2023

Accepting submissions for special issue of Nutrients (Links to an external site)

SPI Associate Director Dan Ferris and faculty affiliate Sarah Moreland-Russell co-editing. Submission deadline May 15, 2024. The topic is “Nutrition Policy and Programs in Educational Settings: Equitable Approaches to Food Security.”

Israeli student visiting WashU wins $3,000 in thesis competition, donates it all to IDF (Links to an external site)

Avnor is a Ph.D. clinical neuropsychology student at the University of Haifa and she is associated with the Social Policy Institute at Washington University in St. Louis.

City of St. Louis, Offices of the Treasurer and Mayor Announce Launch of the STL Guaranteed Basic Income (STL GBI) Pilot, Outline Timeline and Eligibility (Links to an external site)

Washington University in St. Louis’ Social Policy Institute and the Brown School Evaluation Center are partnering with the City for data analysis and evaluation of the program.

Mastercard Impact Fund renews grant to Social Policy Institute

Latest $1.5M grant will extend ongoing work to foster inclusive economic growth in St. Louis The Mastercard Impact Fund, with support from the Mastercard Center for Inclusive Growth —a founding partner of the Social Policy Institute (SPI) at Washington University in St. Louis — will continue its support for SPI with a second round of […]

A Safe Place’: Rural HIV Patients and Providers Fight Stigma, Isolation Through Connection (Links to an external site)

Phil Marotta was quoted regarding his work on HIV in rural areas, and the impact stigma has on important health decisions.

Social Policy Institute to study impact of short-term credentials on advancing equity and meeting local labor market demands

Contact: Jason Jabbari, Associate Director of Community Partnerships, Social Policy Institutejabbari.jason@wustl.edu. ST. LOUIS, Missouri (August 28, 2023) – The Social Policy Institute (SPI) at Washington University in St. Louis has received a two-year, $475,000 grant from the Lumina Foundation. These funds will support a research project aiming to understand the impact of short-term credentials on […]

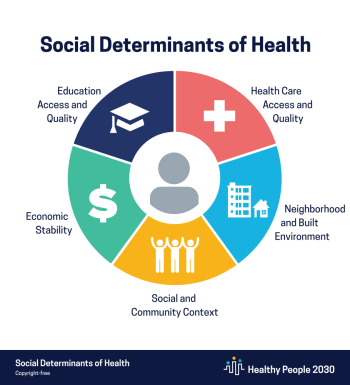

Government Investment Priorities as a Structural Determinant of Health: Interrogating the Carceral Resource Index.

Join us on Thursday, May 4, for a virtual conversation with Northeastern University law professor Leo Beletsky, JD, MPH. About this event Join the Social Policy Institute, WashU School of Medicine, and SAMHSA in a discussion with Professor Leo Beletsky on his work surrounding the Structural Determinants of Health and the use of the Carceral […]

Free Online Course Focuses on Cultivating Collaborative and Equitable Data Practices

Data for Social Impact, an initiative of the Social Policy Institute at Washington University in St. Louis, has launched a free online course for social sector professionals. While many courses develop technical data skills, this course—designed with, by, and for social sector leaders—supports organizations in cultivating equitable, collaborative data practices. Each module includes worksheets, resource […]

“It helped us more than I could have imagined”: How the 2021 Expanded Child Tax Credit Supported Families Raising Children with Disabilities

Summary The 2021 expanded Child Tax Credit (CTC) provided temporary enhancements to the existing CTC for the tax years 2021 and 2022. Under the expanded credit, families with children under the age of 18 were eligible to receive a credit of up to $3,000 per child ($3,600 for children under the age of 6). In […]

How Would Americans Respond to Direct Cash Transfers? Results from Two Survey Experiments

Abstract Universal basic income has gained renewed interest among policy makers and researchers in the United States. Although research indicates that unconditional cash transfers produce diverse benefits for households, public support lags in part because of predicted unemployment and frivolous spending. To understand how Americans would reorganize their lives around unconditional cash transfers, this article […]

Coping with COVID-19: Differences in hope, resilience, and mental well-being across U.S. racial groups

Abstract Objectives To explore if the COVID-19 pandemic revealed differences across racial groups in coping, resilience, and optimism, all of which have implications for health and mental well-being. Methods We collect data obtained from four rounds of a national sample of 5,000 US survey respondents in each round from April 2020 to February 2021. Using […]

Timely and well-targeted financial help during COVID-19: an employer-community partnership for hotel workers in New Orleans

Abstract Economic disruptions related to the COVID-19 pandemic left many households without the income necessary to meet basic needs. We describe an innovative, community-based partnership between a financial services company, philanthropic funders, and employers to provide financial assistance to hotel workers in New Orleans who lost jobs and income due to the COVID-19 pandemic. Results […]

Racial and Ethnic Disparities in Housing Instability During the COVID-19 Pandemic: the Role of Assets and Income Shocks

Abstract Stable and adequate housing is critical to sound public health responses in the midst of a pandemic. This study explores the disproportionate impact of the COVID-19 pandemic on housing-related hardships across racial/ethnic groups in the USA as well as the extent to which these disparities are mediated by households’ broader economic circumstances, which we […]

Does Frequency or Amount Matter? An Exploratory Analysis the Perceptions of Four Universal Basic Income Proposals

Abstract Advocates for a Universal Basic Income (UBI) argue that it would provide citizens with a basic foundation for financial security, boost the economy, alleviate poverty, encourage entrepreneurship, reduce crime, and insulate the employment sector against job losses due to automation. Still, the idea lags in popularity in the United States compared to existing cash […]

Emergency Savings among Persistently Poor Households: Evidence from a Field Experiment

Abstract Low-income households struggle to accumulate emergency savings, which increases economic vulnerability in the face of unexpected events like expensive car repairs. This vulnerability may be even greater among persistently low-income households, which might benefit most from building emergency savings using tax refunds. This study examined the effects of randomly assigned behavioral interventions that incorporated […]

Implementation of Flexibilities to the National School Lunch and Breakfast Programs and Their Impact on Schools in Missouri

Abstract Background: In 2018, the United States Department of Agriculture (USDA) issued flexibilities to the National School Lunch and Breakfast Programs, relaxing the nutrition standards for milk, whole grains, and sodium. This study examines the implementation decision-making among Missouri school food services and the impact of implementing these flexibilities on the meals served. Methods: We […]

Entrepreneurs face headwinds from investment sector (Links to an external site)

President Biden calls for restoring child tax credit (Links to an external site)

Following President Biden’s call to restore the Child Tax Credit, ABC27 cited SPI research demonstrating the positive effects of the policy.

Can behavioral nudges and incentives help lower-income households build emergency savings with tax refunds? Evidence from field and survey experiments

Abstract Tax refunds are an opportunity for lower-income households to accumulate emergency savings so they have cash on hand to cover expenses when income is insufficient. Our field experiments testing different behavioral interventions to encourage refund saving via online tax filing show small effect sizes (0.12–0.14) and a low aggregate savings rate (12%) that might […]

Bank of America awards Operation Food Search $25,000 grant to support its Fresh RX: Nourishing Healthy Starts program (Links to an external site)

$25,000 was awarded to Operation Food Search in order to broaden the Fresh RX program

Bank of America takes fresh approach to fight food insecurity (Links to an external site)

Bank of America has awarded a grant to Operation Food Search, to expand the Fresh RX program.

COVID-19 Safety Concerns, School Governance Models, and Instructional Modes: An Exploration of School Quality Perspectives during the Pandemic

Abstract This paper explores how parents’ COVID-19 safety concerns relate to school governance models (SGMs), instructional modes (i.e. in-person, hybrid, online), and perceptions of school quality during the pandemic. Leveraging two waves of household survey data across 47 states and the District of Columbia, we first conduct a series of multinomial regression analyses to explore […]

Intersecting Race and Gender Across Hardships and Mental Health During COVID-19: A Moderated-Mediation Model of Graduate Students at Two Universities

Abstract While the effects of the pandemic on the mental health of college students can vary across race and gender, few studies have explored the role of hardships and university assistance in these disparities, as well as how these disparities can manifest themselves differently across intersections of race and gender. We address this gap by […]

Infrastructure of social control: A multi-level counterfactual analysis of surveillance and Black education

Abstract In response to the continued reoccurrence of school shootings, policymakers have increased surveillance measures to ensure safer learning environments. However, in addition to being used to preempt school shootings, these surveillance measures may have increased the capacity of schools to identify and punish students for more common and less serious offenses, which may negatively […]

Perceptions of School Quality and Student Learning During the Pandemic: Exploring the Role of Students, Families, Schools, and Neighborhoods

Abstract Given the inequitable distribution of resources across school, neighborhood, and home contexts in the United States, lower resourced students may have had fewer opportunities to learn during the coronavirus disease 2019 pandemic, which may have caused previous disadvantages to accumulate during the pandemic. Nevertheless, research has yet to comprehensively explore how school, neighborhood, and […]

Is Data Maturity the Key to Meeting Your Mission? (Links to an external site)

Jenrose Fitzgerald, program coordinator, is speaking at data.org’s upcoming event on using data to amplify your organization’s impact.

Artificial Intelligence for Social Impact: 5 Guideposts from Our CEO (Links to an external site)

Benefits Data Trust highlighted some key points their CEO, Trooper Sanders, made when he gave the Keynote Address at the DSSI Summit.

Data for Social Impact Summit [Five Key Takeaways]

In November 2022, the Social Policy Institute at Washington University in St. Louis hosted Data is for Everyone: A Data for Social Impact Summit. The summit’s goal was to build connection and capacity among social sector organizations to cultivate equitable, community-centered data practices. The event featured 21 local and national speakers across five panels. Each […]

Jabbari to study social mobility, equity in programs (Links to an external site)

Jason Jabbari, associate director of community partnerships, has been awarded a two-year grant to study social mobility and equity in programs.

The Association for Financial Counseling and Planning Education® (AFCPE®) Announced 2022 Award Recipients Impacting the Personal Finance Field (Links to an external site)

AFCPE announced their award winners for 2022, and SPI research won Outstanding Research Journal Article of the Year.

Financial Well-being of Frontline Healthcare Workers: The Importance of Employer Benefits

Summary Frontline healthcare workers – especially direct care workers (DCWs), such as home health aides, struggle due to low pay, lack of benefits, and difficult working conditions. The need for these workers is growing. Unless frontline healthcare jobs improve, positions may be difficult to fill, and care for vulnerable members of society may be compromised. […]

Social mobility as a priority will open doors for Israeli children – opinion (Links to an external site)

Social Policy Institute research was cited in this opinion piece on social mobility and its impact on children in Israel.

Male Caregivers and Engagement in a Family Strengthening Program for Child Disruptive Behavior Disorders

Abstract Awareness and interest in involving male caregivers in child mental health treatment has grown, especially for youth with disruptive behavior disorders like oppositional defiant disorder (ODD). The purpose of this study was to examine the relationship between male caregiver involvement and treatment engagement for child ODD. Children (n = 122) ages 7–11 and their caregivers participated […]

Prevalence of Long-COVID Among Low-Income and Marginalized Groups: Evidence From Israel

Abstract Objective: To identify the socioeconomic and demographic factors associated with the prevalence of self-reported long-COVID symptoms. Method: We examined the association between acute-COVID (SARS-CoV-2) and long-COVID symptoms, by a cross-sectional analysis of data obtained on a prospective online-survey, conducted from November to December 2021 on a nationally-representative sample of the Israeli population (N = 2,246). Results: Findings […]

Changes in food insecurity levels during the COVID-19 economic crisis: Differences based on sociodemographic factors

By Oren Heller, research director, Israel; Yaniv Shlomo, Data Analyst, Israel; Hayley Kalb, communications assistant; Michal Grinstein-Weiss, founding director Food insecurity is a national problem with short and long-term consequences that harm the economy and society. This problem was exacerbated by the COVID-19 pandemic, as the labor market changed, affecting the disposable income of many […]

Predictors of and Barriers to Receipt of Advance Premium Tax Credits

Abstract Objectives: The Advance Premium Tax Credit (APTC) is designed to remedy lack of health insurance due to cost; however, approximately 30 million Americans remain without health insurance, and millions of households leave billions in tax credits unclaimed each year. A prerequisite of APTC is to file one’s taxes; however, few studies have examined tax filing […]

5 Ways Public Health Keeps Communities Healthy (Links to an external site)

Tyler Frank, doctoral research assistant, published this blog on GoodRX Health discussing how public health helps promote social justice, equity, and collective action, and how it keeps communities safe.

Lessons from a global team

I truly believe we can accomplish more by stepping outside of our own culture and seek to understand and learn from each other. This is what makes SPI’s global approach to its work so impactful. I look forward to hosting WashU colleagues in Israel next time.

Human-centered approach to benefits research for health care field

By Kourtney Gilbert, program coordinator, SPI As researchers, we work a lot with numbers on a page. These numbers often feel distant from the people they represent, or the policy and practices we hope to inform. For this reason, when the Social Policy Institute launched its Building on Benefits research project aimed at better understanding […]

Should we cancel student debt or make loan repayment affordable? Lessons from the U.S. and U.K. (Links to an external site)

Mastercard partners with WashU to promote inclusive growth (Links to an external site)

SPI research to be presented at Association for Public Policy Analysis and Management conference

Social Policy Institute research will be presented in seven different panels during the APPAM conference Nov. 17 to Nov. 18, 2022. Below are the papers and discussions that will be presented by the SPI team, including staff and faculty affiliates.

How do health care costs impact household finances and access to care?

Prioritizing affordability of care will be the first step to ensuring that a healthy life is feasible for everyone regardless of finances.

Household Financial Security: What can we learn from research in the U.K.?

A Trans-Atlantic Policy Forum could bring together academic researchers,

policy makers, advocates, and corporate leaders in the U.S. and U.K. to develop

insights to fuel changes in public policies and corporate behavior to promote the

financial security of low- and moderate-income (LMI) individuals and families.