To inform the Data Science for Social Impact initiative, SPI hosted a series of public roundtable discussions in partnership with the Mastercard Center for Inclusive Growth, data.org, and the St. Louis Regional Data Alliance in 2021. This report documents the information gathered at the first two discussions.

Category: SPI

Racial and Ethnic Disparities in Housing Instability during the COVID-19 Pandemic: The Role of Assets and Income Shocks

Abstract Stable and adequate housing is critical in the midst of a pandemic; without housing, individuals and families cannot shelter in place to prevent the spread of disease. Understanding and combating housing hardships in vulnerable populations is therefore essential to a sound public health response. This study aims to explore the pandemic’s disproportionate impacts on […]

Employment, Financial and Well-being Effects of the 2021 Expanded Child Tax Credit: Wave 1 Executive Summary

The 2021 temporary expansion of the Child Tax Credit (CTC) is unprecedented in its reach and is predicted to cut American child poverty by more than half. The expanded CTC provides families with $3,600 for every child in the household under the age of six and $3,000 for every child between the ages of six […]

Policy & Practice Strategies for Inclusive Growth in St. Louis

A 6-part event series, Inclusive Growth in St. Louis investigated who is left out of St. Louis’ economic growth benefits, the policies that have led to the unequal distribution of opportunities, and actionable recommendations to become a more inclusive economy. This report summarizes those discussions and recommendations.

Crashing without a Parachute: Racial and Educational Disparities in Unemployment during COVID-19

Abstract The burden of the COVID-19 pandemic has not been shouldered equally by American families. Black and Hispanic communities have been hit the hardest, with the pandemic often exacerbating existing disparities. Using nationally representative data, we assess the economic and public health effects of the pandemic among different socioeconomic groups and whether typical sources of […]

Introduction: The COVID-19 Shock to Our Deep Inequities: How to Mitigate the Impact

The COVID-19 pandemic affected nearly every aspect of household health, as well as the social and economic well-being of individuals and communities across the United States. Many in our society have faced and continue to face unprecedented challenges. Specifically, the pandemic put a microscope on inequities such as racial disparities in housing, health care, and […]

The Precarity of Self-Employment among Low- and Moderate-Income Households

Abstract Many people in the United States have achieved economic stability through self-employment and are often seen as embracing the entrepreneurial spirit and seizing opportunity. Yet, research also suggests that self-employment may be precarious for many people in the lower socioeconomic strata. Drawing on a unique dataset that combines longitudinal survey data with administrative tax […]

The Impact of Tax Refund Delays on the Experience of Hardship Among Lower-Income Households

Abstract The Earned Income Tax Credit (EITC) provides substantial financial support to low-income workers in the USA, yet around a quarter of EITC payments are estimated to be erroneous or fraudulent. Beginning in 2017, the Protecting Americans from Tax Hikes Act of 2015 requires the Internal Revenue Service to spend additional time processing early EITC […]

Public perceptions and the willingness to get vaccinated against COVID-19: Lessons from Israel

Abstract Objectives To explore the associations between vaccine hesitancy and demographic and socio-economic characteristics, as well as perspective towards the COVID-19 and its vaccines. Methods Data were collected through four online surveys on Israel’s representative sample in March (3/2 to 3/7, n = 1517), August (8/10–8/11, n = 925; 8/18–8/22, n = 1054), and September (9/22-9/24; n=1406), 2021. We employ a […]

Expanded Child Tax Credit payments have not reduced employment

Approximately 60 million American children living in 35 million households received monthly payments from the federal government as part of the temporary Child Tax Credit (CTC) expansion. Discourse over whether or not the expanded CTC caused parents to leave the workforce emerged during the period of the expanded credit. On one side, a large number […]

All over the Map: A Systematic Literature Review and State Policy Scan of Medicaid Buy-In Programs for Working Individuals with Disabilities

Abstract While supports for people with disabilities have increased, significant healthcare and financial barriers persist. State-administered Medicaid Buy-In programs for working people with disabilities, distinct from broader buy-in discussions that have emerged as some states consider expanding access to health insurance, are intended to incentivize employment and protect against a loss of Long-Term Services and […]

The impacts of the 2021 expanded Child Tax Credit on family employment, nutrition, and financial well-being

The 2021 temporary expansion of the child tax credit (CTC) was unprecedented in its reach, lifting 3.7 million children out of poverty as of December 2021. It provided families with up to $3,600 for every child in the household under the age of six and up to $3,000 for every child between the ages of […]

Nothing to show for it: Financial Distress and Re-Enrollment Aspirations for those with non-degreed debt

Abstract The number of individuals with student loan debt who do not earn their degrees is on the rise; nevertheless, there is little research that demonstrates their current circumstances and future aspirations. We address this knowledge gap by comparing the financial distresses and re-enrollment aspirations of student debt-holders who started college but did not earn […]

COVID-19 job and income loss and mental health: the mediating roles of financial assets and well-being and the moderating role of race/ethnicity

Abstract Prior research shows unemployment has a negative effect on mental health, yet whether this relationship is affected by financial factors is unknown. For example, having money in savings may mitigate the impact of job loss on mental health. We use structural equation modeling with data from the Socio-Economic Impacts of COVID-19 Survey with a […]

Who Protests, What Do They Protest, and Why?

Abstract We examine individuals’ decisions to attend protests during the summer of 2020. Our analysis examines two simultaneous movements: Black Lives Matter along with protests calling for less stringent public health measures to combat the COVID-19 (e.g., for swifter reopening of businesses). Our analysis is made possible by a unique staggered panel data set that […]

Disrupted and Disconnected: Child Activities, Social Skills, and Race/Ethnicity During the Pandemic

Abstract Early in the COVID-19 pandemic, parents reported that their children spent the majority of their time at home, which can dramatically change their activities and negatively impact their social skills. However, research has yet to uncover the relationships between changes in activities during the pandemic and children’s social skills, nor the degree to which […]

Disparate financial assistance support for small business owners

Small business owners experienced a drastic economic disruption caused by the COVID-19 pandemic. Government pandemic assistance failed to reach many small business owners, especially those historically underserved by financial institutions. Drawing on a 2021 survey of 246 small business owners, the Social Policy Institute at Washington University in St. Louis descriptively examined the extent to […]

How Would Americans Respond to Direct Cash Transfers? Results from Two Survey Experiments

The Earned Income Tax Credit (EITC) provides substantial financial support to low-income Universal basic income has gained renewed interest among policymakers and researchers in the U.S. While research indicates that unconditional cash transfers produce diverse benefits for households, public support lags in part due to the predicted unemployment and frivolous spending. To understand how Americans […]

Experimental Evidence on Consumption, Saving, and Family Formation Responses to Student Debt Forgiveness (Links to an external site)

The Earned Income Tax Credit (EITC) provides substantial financial support to low-income Universal basic income has gained renewed interest among policymakers and researchers in the U.S. While research indicates that unconditional cash transfers produce diverse benefits for households, public support lags in part due to the predicted unemployment and frivolous As policy-makers grapple with whether […]

“Take my word for it”: Group Texts and Testimonials Enhance State and Federal Student Aid Applications

Abstract As the cost of college continues to rise, it has become increasingly important for students to apply for financial aid. However, many students are unaware of the benefits of the Free Application for Federal Student Aid (FAFSA). We launched a field experiment with a non-profit organization to explore how both informational- and testimonial-type text […]

Predictors of and Barriers to Receipt of Advance Premium Tax Credits

Abstract Objectives: The Advance Premium Tax Credit (APTC) is designed to remedy lack of health insurance due to cost; however, approximately 30 million Americans remain without health insurance, and millions of households leave billions in tax credits unclaimed each year. A prerequisite of APTC is to file one’s taxes; however, few studies have examined tax filing […]

Prevalence of Long-COVID Among Low-Income and Marginalized Groups: Evidence From Israel

Abstract Objective: To identify the socioeconomic and demographic factors associated with the prevalence of self-reported long-COVID symptoms. Method: We examined the association between acute-COVID (SARS-CoV-2) and long-COVID symptoms, by a cross-sectional analysis of data obtained on a prospective online-survey, conducted from November to December 2021 on a nationally-representative sample of the Israeli population (N = 2,246). Results: Findings […]

Male Caregivers and Engagement in a Family Strengthening Program for Child Disruptive Behavior Disorders

Abstract Awareness and interest in involving male caregivers in child mental health treatment has grown, especially for youth with disruptive behavior disorders like oppositional defiant disorder (ODD). The purpose of this study was to examine the relationship between male caregiver involvement and treatment engagement for child ODD. Children (n = 122) ages 7–11 and their caregivers participated […]

Financial Well-being of Frontline Healthcare Workers: The Importance of Employer Benefits

Summary Frontline healthcare workers – especially direct care workers (DCWs), such as home health aides, struggle due to low pay, lack of benefits, and difficult working conditions. The need for these workers is growing. Unless frontline healthcare jobs improve, positions may be difficult to fill, and care for vulnerable members of society may be compromised. […]

Perceptions of School Quality and Student Learning During the Pandemic: Exploring the Role of Students, Families, Schools, and Neighborhoods

Abstract Given the inequitable distribution of resources across school, neighborhood, and home contexts in the United States, lower resourced students may have had fewer opportunities to learn during the coronavirus disease 2019 pandemic, which may have caused previous disadvantages to accumulate during the pandemic. Nevertheless, research has yet to comprehensively explore how school, neighborhood, and […]

Infrastructure of social control: A multi-level counterfactual analysis of surveillance and Black education

Abstract In response to the continued reoccurrence of school shootings, policymakers have increased surveillance measures to ensure safer learning environments. However, in addition to being used to preempt school shootings, these surveillance measures may have increased the capacity of schools to identify and punish students for more common and less serious offenses, which may negatively […]

Intersecting Race and Gender Across Hardships and Mental Health During COVID-19: A Moderated-Mediation Model of Graduate Students at Two Universities

Abstract While the effects of the pandemic on the mental health of college students can vary across race and gender, few studies have explored the role of hardships and university assistance in these disparities, as well as how these disparities can manifest themselves differently across intersections of race and gender. We address this gap by […]

COVID-19 Safety Concerns, School Governance Models, and Instructional Modes: An Exploration of School Quality Perspectives during the Pandemic

Abstract This paper explores how parents’ COVID-19 safety concerns relate to school governance models (SGMs), instructional modes (i.e. in-person, hybrid, online), and perceptions of school quality during the pandemic. Leveraging two waves of household survey data across 47 states and the District of Columbia, we first conduct a series of multinomial regression analyses to explore […]

Can behavioral nudges and incentives help lower-income households build emergency savings with tax refunds? Evidence from field and survey experiments

Abstract Tax refunds are an opportunity for lower-income households to accumulate emergency savings so they have cash on hand to cover expenses when income is insufficient. Our field experiments testing different behavioral interventions to encourage refund saving via online tax filing show small effect sizes (0.12–0.14) and a low aggregate savings rate (12%) that might […]

Implementation of Flexibilities to the National School Lunch and Breakfast Programs and Their Impact on Schools in Missouri

Abstract Background: In 2018, the United States Department of Agriculture (USDA) issued flexibilities to the National School Lunch and Breakfast Programs, relaxing the nutrition standards for milk, whole grains, and sodium. This study examines the implementation decision-making among Missouri school food services and the impact of implementing these flexibilities on the meals served. Methods: We […]

Emergency Savings among Persistently Poor Households: Evidence from a Field Experiment

Abstract Low-income households struggle to accumulate emergency savings, which increases economic vulnerability in the face of unexpected events like expensive car repairs. This vulnerability may be even greater among persistently low-income households, which might benefit most from building emergency savings using tax refunds. This study examined the effects of randomly assigned behavioral interventions that incorporated […]

Does Frequency or Amount Matter? An Exploratory Analysis the Perceptions of Four Universal Basic Income Proposals

Abstract Advocates for a Universal Basic Income (UBI) argue that it would provide citizens with a basic foundation for financial security, boost the economy, alleviate poverty, encourage entrepreneurship, reduce crime, and insulate the employment sector against job losses due to automation. Still, the idea lags in popularity in the United States compared to existing cash […]

Racial and Ethnic Disparities in Housing Instability During the COVID-19 Pandemic: the Role of Assets and Income Shocks

Abstract Stable and adequate housing is critical to sound public health responses in the midst of a pandemic. This study explores the disproportionate impact of the COVID-19 pandemic on housing-related hardships across racial/ethnic groups in the USA as well as the extent to which these disparities are mediated by households’ broader economic circumstances, which we […]

Timely and well-targeted financial help during COVID-19: an employer-community partnership for hotel workers in New Orleans

Abstract Economic disruptions related to the COVID-19 pandemic left many households without the income necessary to meet basic needs. We describe an innovative, community-based partnership between a financial services company, philanthropic funders, and employers to provide financial assistance to hotel workers in New Orleans who lost jobs and income due to the COVID-19 pandemic. Results […]

Coping with COVID-19: Differences in hope, resilience, and mental well-being across U.S. racial groups

Abstract Objectives To explore if the COVID-19 pandemic revealed differences across racial groups in coping, resilience, and optimism, all of which have implications for health and mental well-being. Methods We collect data obtained from four rounds of a national sample of 5,000 US survey respondents in each round from April 2020 to February 2021. Using […]

How Would Americans Respond to Direct Cash Transfers? Results from Two Survey Experiments

Abstract Universal basic income has gained renewed interest among policy makers and researchers in the United States. Although research indicates that unconditional cash transfers produce diverse benefits for households, public support lags in part because of predicted unemployment and frivolous spending. To understand how Americans would reorganize their lives around unconditional cash transfers, this article […]

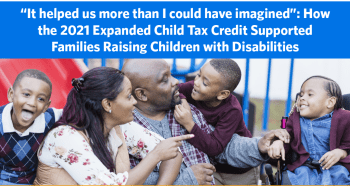

“It helped us more than I could have imagined”: How the 2021 Expanded Child Tax Credit Supported Families Raising Children with Disabilities

Summary The 2021 expanded Child Tax Credit (CTC) provided temporary enhancements to the existing CTC for the tax years 2021 and 2022. Under the expanded credit, families with children under the age of 18 were eligible to receive a credit of up to $3,000 per child ($3,600 for children under the age of 6). In […]

Center for Social Development, Social Policy Institute Announce Strategic Integration (Links to an external site)

Two renowned research centers become one, with expanded leadership, a broader research agenda and greater potential for policy and program impacts. The start of this integration is a key step in the broader beginning of a new era of leadership and excellence in social development and policy at Washington University’s Brown School.

Learn more

Social Policy Institute Welcomes Second Cohort of Doctoral Scholars

We’re thrilled to announce and welcome a new group of emerging leaders in policy research and translation to the JPMC Social Policy Research Scholars Program! This initiative, now in its second year, supports doctoral students from historically marginalized groups underrepresented in academia in their efforts to create a more inclusive, socially, racially, and economically just […]

St. Louis Social Sector Leaders Discuss Data Equity at STL DataFest 2024

What is the role of data in improving impact? And why is this a matter of equity? St. Louis social sector leaders addressed these questions in a panel discussion at STL DataFest 2024 titled Power in Numbers: How Data for Social Impact Cultivates Inclusive Growth on Friday, May 17. The panel was moderated by Simon Huang, Chief Technology Officer for […]

Data for Social Impact Initiative Launches Data Equity Learning Cohort

To build connection and capacity for social sector leaders in equitable, collaborative data practice, Data for Social Impact (DSI), an initiative of the Social Policy Institute at Washington University in St. Louis, launched a Data Equity learning cohort in January 2024 in collaboration with Actionable Intelligence for Social Policy (AISP) of the University of Pennsylvania. […]

STEM training, apprenticeships increase work satisfaction (Links to an external site)

Participation in a science, technology, engineering and math (STEM) apprenticeship program increased job happiness, finds a new study from the Brown School at Washington University in St. Louis.

SPI sessions at the 2023 Association for Public Policy Analysis and Management (APPAM) Conference

Four Social Policy Institute researchers presented their papers and hosted discussions at the Association for Public Policy Analysis and Management (APPAM) conference from November 9-11, 2023. Below are the papers and discussions presented by the SPI team. Thursday, November 9, 2023 Friday, November 10, 2023 Saturday, November 11, 2023

Accepting submissions for special issue of Nutrients (Links to an external site)

SPI Associate Director Dan Ferris and faculty affiliate Sarah Moreland-Russell co-editing. Submission deadline May 15, 2024. The topic is “Nutrition Policy and Programs in Educational Settings: Equitable Approaches to Food Security.”

Israeli student visiting WashU wins $3,000 in thesis competition, donates it all to IDF (Links to an external site)

Avnor is a Ph.D. clinical neuropsychology student at the University of Haifa and she is associated with the Social Policy Institute at Washington University in St. Louis.

City of St. Louis, Offices of the Treasurer and Mayor Announce Launch of the STL Guaranteed Basic Income (STL GBI) Pilot, Outline Timeline and Eligibility (Links to an external site)

Washington University in St. Louis’ Social Policy Institute and the Brown School Evaluation Center are partnering with the City for data analysis and evaluation of the program.

Mastercard Impact Fund renews grant to Social Policy Institute

Latest $1.5M grant will extend ongoing work to foster inclusive economic growth in St. Louis The Mastercard Impact Fund, with support from the Mastercard Center for Inclusive Growth —a founding partner of the Social Policy Institute (SPI) at Washington University in St. Louis — will continue its support for SPI with a second round of […]

A Safe Place’: Rural HIV Patients and Providers Fight Stigma, Isolation Through Connection (Links to an external site)

Phil Marotta was quoted regarding his work on HIV in rural areas, and the impact stigma has on important health decisions.

Social Policy Institute to study impact of short-term credentials on advancing equity and meeting local labor market demands

Contact: Jason Jabbari, Associate Director of Community Partnerships, Social Policy Institutejabbari.jason@wustl.edu. ST. LOUIS, Missouri (August 28, 2023) – The Social Policy Institute (SPI) at Washington University in St. Louis has received a two-year, $475,000 grant from the Lumina Foundation. These funds will support a research project aiming to understand the impact of short-term credentials on […]

Government Investment Priorities as a Structural Determinant of Health: Interrogating the Carceral Resource Index.

Join us on Thursday, May 4, for a virtual conversation with Northeastern University law professor Leo Beletsky, JD, MPH. About this event Join the Social Policy Institute, WashU School of Medicine, and SAMHSA in a discussion with Professor Leo Beletsky on his work surrounding the Structural Determinants of Health and the use of the Carceral […]