Press Release: September 25, 2020

The potentially catastrophic, long-term financial impacts of COVID-19 on young adults are highlighted in the Socioeconomic Impacts of COVID-19 Survey[1] in Israel, which was administered between June 4 and July 1 by the Social Policy Institute at Washington University in St. Louis in partnership with Mastercard.

The survey results found that young adults in their early 20s to late 30s have experienced a harsher financial impact from COVID-19 than middle-age adults (between 40 and 55 years old), and older adults (between 56 and 74 years old).

Unlike their parents and grandparents, younger Israelis have had less time to build wealth and savings to weather financial shocks brought on by the economic turmoil of COVID-19. Evidence indicates that this crisis moment may have devastating long-term impacts on this generation before they even have an opportunity to acquire assets.

Three indicators of long-term, generational impact for young Israelis during the first three months of the pandemic:

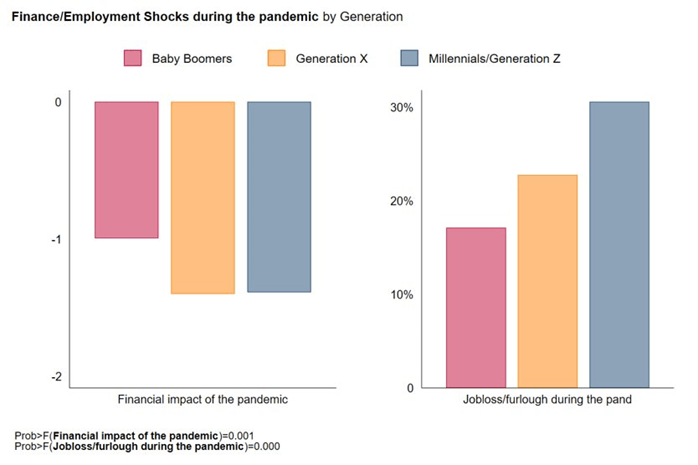

1. High rates of job loss: Young adults were nearly twice as likely (31%) to report job/income loss as older adults (17%). (Figure 1)

Figure 1:

2. Inability to afford basic needs: Young adults were almost three times as likely to report mortgage or rent delinquency (13.3%) and utility payment delay (23.6%), as compared with older adults (4.7% and 9.2%, respectively).

- Not surprisingly, a higher rate of young adults (26.3%) also reported struggling with food insecurity as a result of the pandemic, as compared with older adults (17.2%). (Figure 2)

Figure 2:

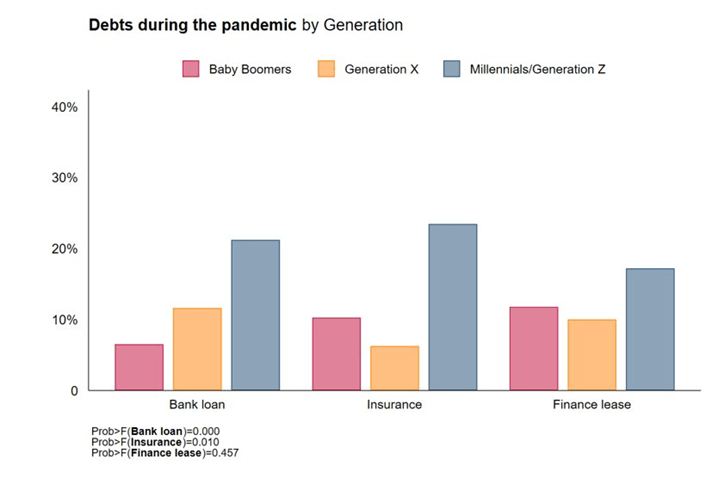

3. Significant debt: As job loss and delayed bill payment would indicate, young adults are also falling behind on their debt or in collections to a greater extent than older generations.

- More than three times as many young adults (13.3%) reported being behind or in collections on non-housing bank loans as compared with older adults (4.7%). (Figure 3)

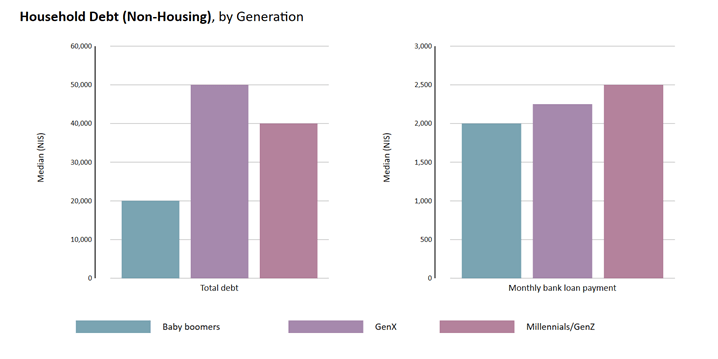

- Among those with loans, while middle-aged adults reported having the highest median non-housing debt ($50,000) as compared with young adults ($40,000) and older adults ($20,000), the median monthly payment for bank loans was highest amongst millennials at $2,500. (Figure 4)

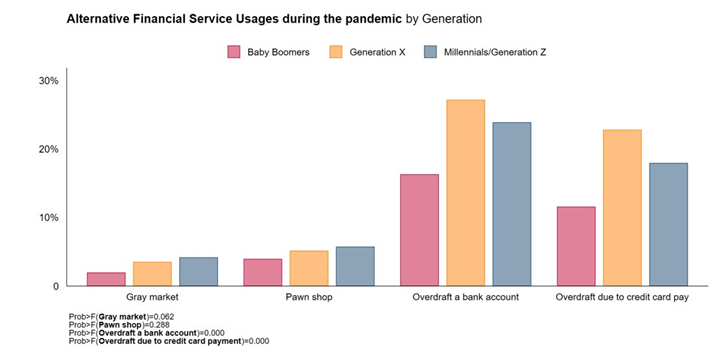

- Many people are intensifying the financial strain caused by the pandemic by over-drafting their bank accounts. Both middle-aged adults (27.2%) and young adults (23.9%) over drafted their bank account more often than older adults (16.3%). (Figure 5)

Figure 3:

Figure 4:

Figure 5:

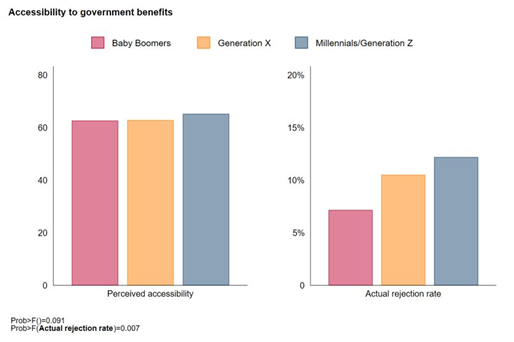

COVID-19 is making it more difficult or impossible for young adults to pay for basic necessities and many are falling behind on bills and loans and over-drafting accounts to help make ends meet. While the government intended to alleviate some of this hardship through extended unemployment benefits and a one-time payment to households in April, it was again young adults who were denied benefits most often—12.2% of young adults reported being denied COVID-19-related benefits, as compared with 10.5% middle-age adults and 7.2% older adults. (Figure 6)

Figure 6:

While this data is concerning, the fact that this survey was conducted prior to the second national shutdown indicates the socioeconomic impact will only worsen. Young adults have faced a recession, national turmoil and now a pandemic. Without governmental policies that specifically plan for inclusive, equitable recovery, the repercussions could be catastrophic for this generation of Israelis and the next.

[1]Sample sizes: young adults, 1,248 (54.2%); middle-age adults, 493 (21.4%); older adults, 560 (24.3%)