The temporary expansion of the Child Tax Credit (CTC) is projected to cut American child poverty by more than half. The CTC expansion provides families with $3,600 for every child in the household under the age of six and $3,000 for every child between the ages of six and 17. The vast majority of U.S. families with children are eligible for the CTC.

These briefs use data from the Census Household Pulse survey to examine how a representative sample of CTC-eligible families making less than $150,000 a year report using their payments. This survey was administered between July 21 and August 16, covering the period in which the first two CTC payments were deposited in families’ bank account. These fact sheets include key data on CTC receipt, payment usage, and changes in families’ food security after the payments went out.

The briefs below are segmented by region and currently include 50 states. For a single downloadable pdf of all of the states view our full report here. This study was funded by the Annie E. Casey Foundation.

Have questions about the study? Email us at socialpolicyinstitute@wustl.edu.

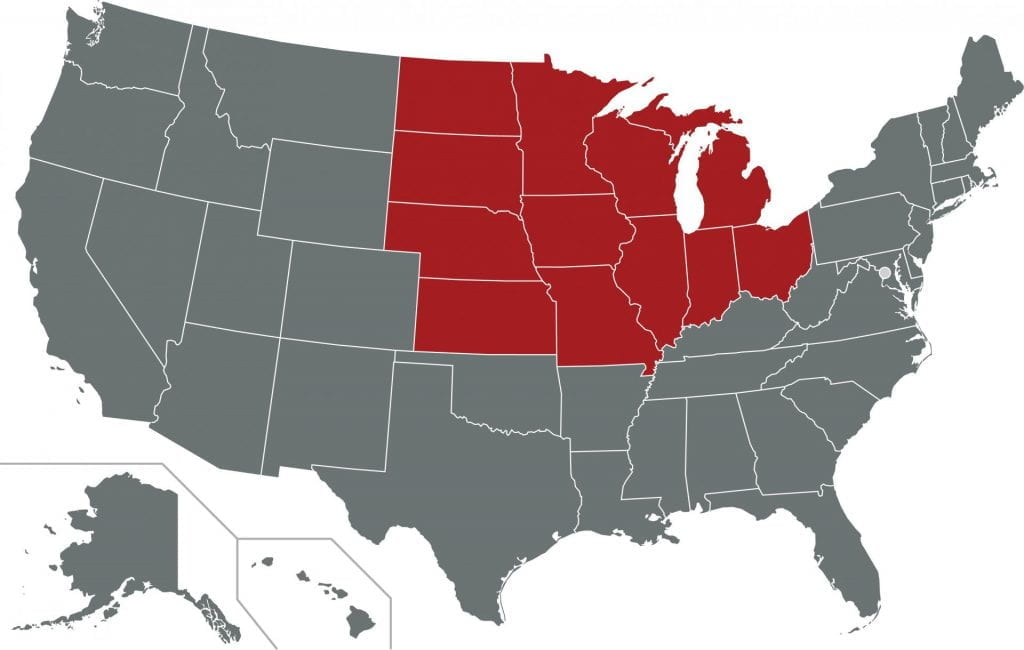

Midwestern State Briefs

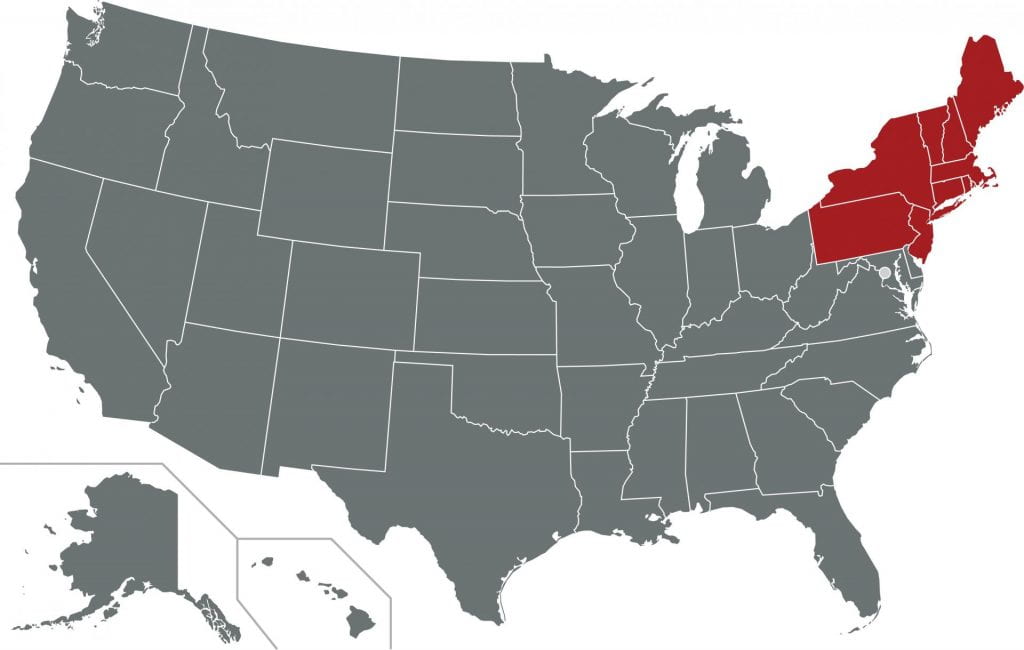

Northeastern State Briefs

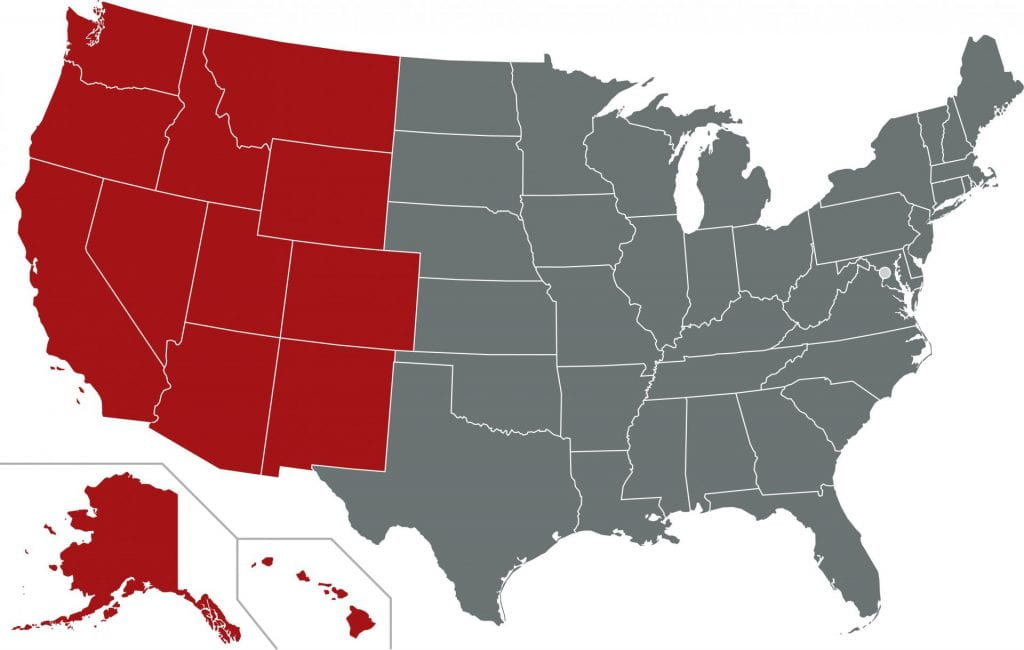

Western State Briefs

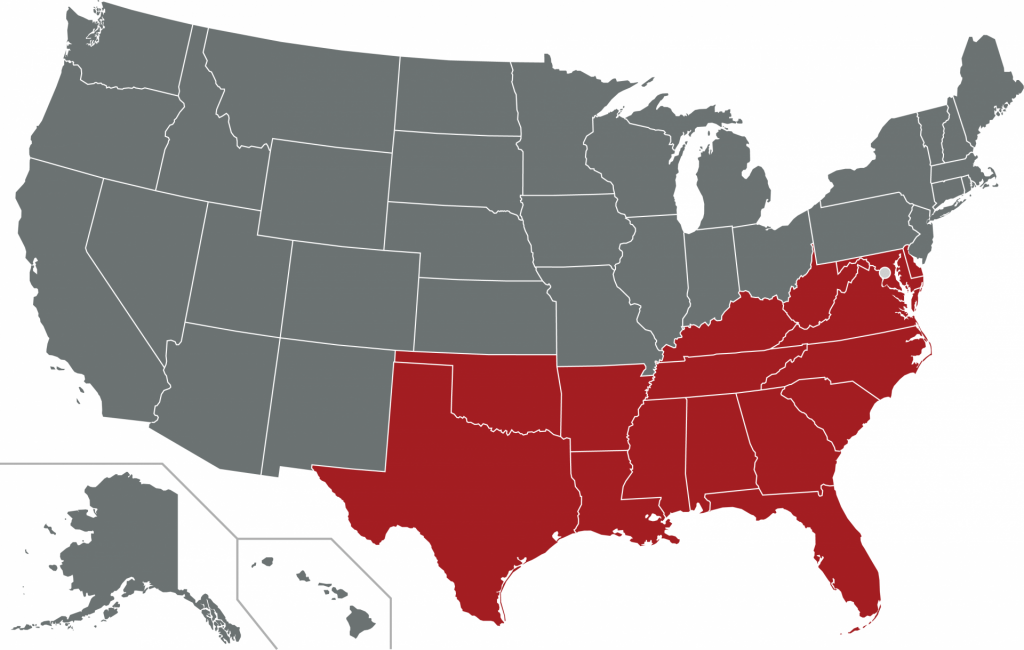

Southern State Briefs

Note: Puerto Rico and other territories are not included because while they are eligible for the expanded CTC, there is no provision for them to file for or receive advance payments. Additionally, the territories are not included in the Household Pulse Surveys so updated data about household impacts are not available for analysis.

Citation

Roll, Stephen; Chun, Yung; Brugger, Laura; and Hamilton, Leah. “How are families in the U.S. using their Child Tax Credit payments? A 50 State Analysis.” (2021). Social Policy Institute Research.

One Comment

Comments are closed.