On May 26, Governor Mike Parson announced the Medicaid Expansion Amendment would be moved up to the August 4, 2020 primary ballot. Despite the governor’s explanation of creating more time to budget the expansion, the move to an election with historically low voter turnout threatens the passage of the bill at a time when Medicaid is more important than ever.

The critical need for Medicaid expansion is supported by new research conducted by the Social Policy Institute (SPI) at Washington University in St. Louis. SPI administered a nationally representative survey to households in the United States. This study looks specifically at the responses from low- and moderate-income households (LMI), which make up roughly 60% of the U.S. population. The new data provide alarming statistics showing that in the first three months of the COVID-19 pandemic, LMI households have had dramatic shifts in the number of the uninsured and glaring declines in the use of health care services.

Impact and Rise of Uninsured Americans

Even before the pandemic, more than a half-million adults in Missouri were uninsured — the vast majority of whom worked in jobs that did not offer health insurance and could not afford private insurance. Because Missouri had not expanded the Medicaid program, these working adults were unable to qualify for this public lifeline.

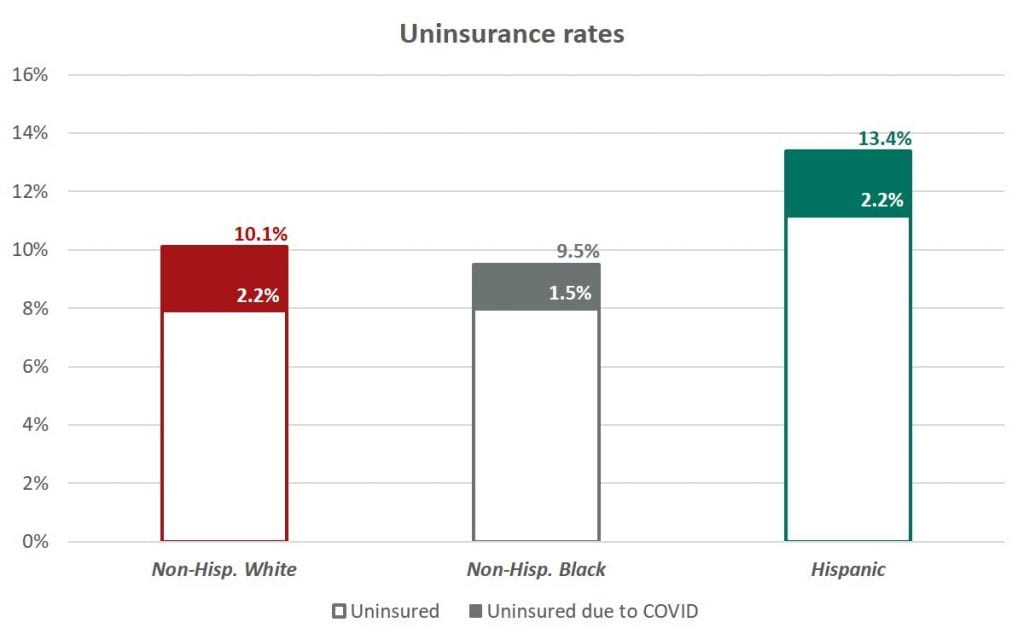

What is particularly devastating is that the new survey results show how rates of the uninsured spiked during the first three months of the COVID-19 pandemic nationally, so we expect to see similar trends in Missouri. Currently, being without insurance affects all of the LMI population, with the largest percentages of the uninsured in Hispanic (13%), non-Hispanic Black (10%), and non-Hispanic White (10%) households.

Figure 1. Uninsurance rate changes over the first 3 months of the COVID-19 pandemic.

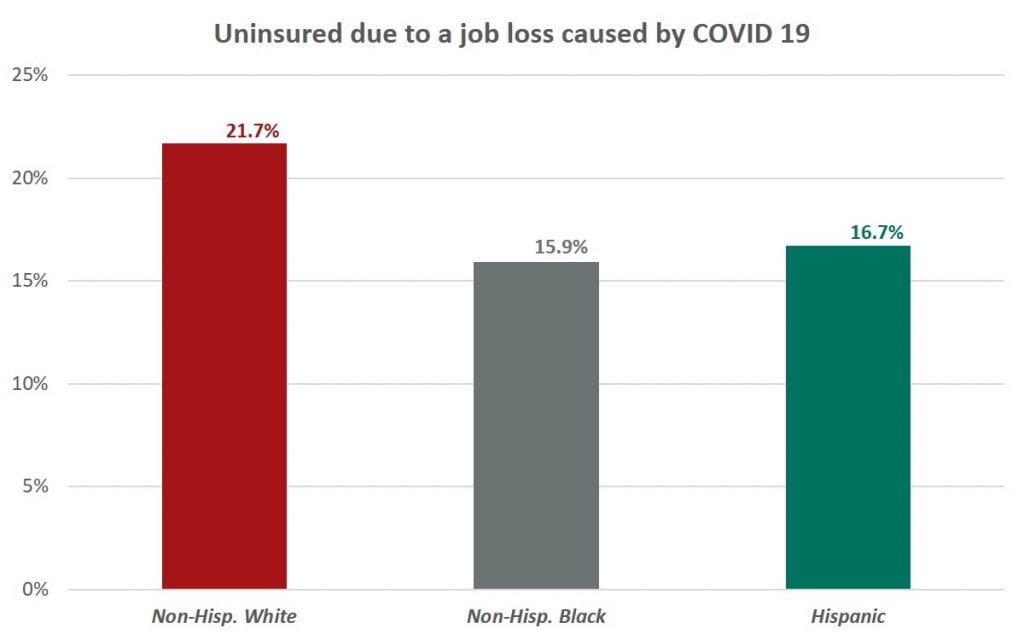

What is of greater concern is that these numbers will likely grow as we continue to deal with the social and economic impacts of the pandemic. COVID-19 has brought unemployment to historic highs, and with more than 40 million people across the country filing for unemployment, losing a job during the pandemic doesn’t mean just losing income — but also losing access to health insurance. The national SPI survey found that among LMI individuals who had health insurance before the pandemic, job loss because of COVID-19 has meant significant numbers of these individuals are now uninsured (22% White, 17% Hispanic, and 16% Black). However, being uninsured is not just an individual problem, it is also a household problem because the job loss means the whole household loses access to health insurance.

Figure 2. Uninsured due to a job loss caused by the COVID-19 pandemic.

Clearly, COVID-19 has been devastating to both the health and finances of LMI families. Not having insurance, especially in uncertain economic times, means people are more likely to forego routine and needed care, often because they are unable to pay the high out-of-pocket costs.

The survey data collected over the first 3 months of the pandemic show how being uninsured can lead to long-term health consequences:

- 11% of LMI individuals did not seek medical care when needed, and

- Nearly 10% of LMI individuals could not/postponed filling a prescription for medication.

During the pandemic, delaying or skipping medical care could mean that LMI individuals are less likely to be tested for the coronavirus, which will limit Missouri’s ability to trace infection routes and control outbreaks. Even more frightening, because of health care costs, uninsured individuals might be less likely to seek care if they begin to experience symptoms of COVID-19 or other infectious diseases.

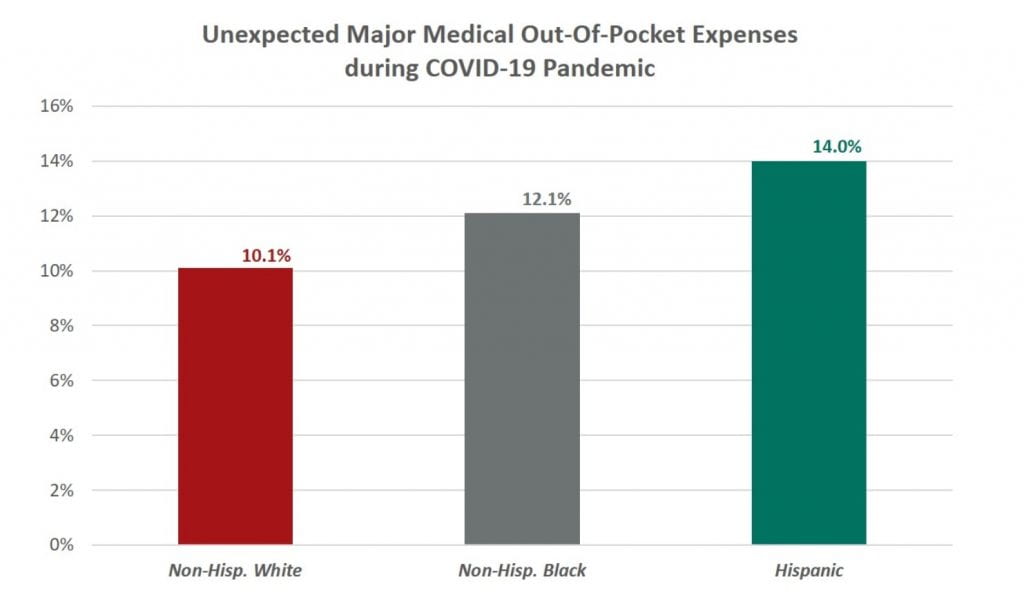

Unexpected medical costs are nearly always a major financial shock for LMI households, and such shocks are amplified during a pandemic. The SPI survey found almost one in 10 respondents reported experiencing unexpected major out-of-pocket medical expenses during the first 3 months of the COVID-19 pandemic. However, despite experiencing a need for medical care, almost two in five of these respondents had reduced their spending on medical/dental care during the pandemic. Another one in 10 respondents reported using their CARES relief payment for medical/dental expenses. Even with CARES payments, many uninsured LMI households are facing mounting unpaid medical bills (on average, their medical debt amount increased by $1,130 during the pandemic).

Figure 3. Unexpected Major Medical Out-of-Pocket Expenses during COVID-19 Pandemic

While some people might have postponed medical care because they wanted to avoid health care settings and reduce their risk of becoming infected with COVID-19, these numbers do not alter the fact that once the pandemic subsides, we will see a decline in health outcomes among LMI individuals.

Medicaid expansion in Missouri is needed now more than ever.

It is time to expand Medicaid in Missouri. Before the pandemic, if Medicaid expansion had been passed in Missouri, an estimated 200,000 Missouri residents would have been given access to health insurance. Now, expanding Medicaid would likely benefit a significantly higher number of Missouri residents — and importantly — without a large expense to the state budget.1

The COVID-19 pandemic has shook every aspect of life as we knew it, but those with access to health care have certainly been able to navigate the pandemic better than those without health insurance. Data tells us that individuals in Missouri and across the country need support. Expanding Medicaid will help ensure more individuals receive affordable and timely care, thus potentially preventing additional health complications during and beyond the pandemic. More than anything, it is simply the right thing to do.