Like many families across the globe, Israeli families have been facing the challenges of raising children during the COVID-19 pandemic. Not only do Israeli families have to adjust to large changes in their child(ren)’s schooling, but they are also forced to cope with the financial shocks, such as job and/or income loss that come with the COVID-19 pandemic. With nearly one in four Israelis reporting employment shock in the early months of the pandemic—either furlough or loss of a job—it is evident that families with children will likely bear the greater burden of financial distress. Using data from the Socioeconomic Impact of COVID-19 Survey in Israel administered by Social Policy Institute at Washington University in St. Louis, we explore the financial burden of COVID-19 on Israeli families.

The Socioeconomic Impacts of COVID-19 Survey in Israel is a national online survey with approximately 2,300 respondents. The data were collected from June 4, 2020, to July 1, 2020. To explore the financial burden of COVID-19 on Israeli families with children during the early months of the pandemic, we focused on four key indicators of financial distress: (1) bank account overdraft; (2) difficulty paying rent or mortgage; (3) difficulty paying non-housing bills; and (4) difficulty to afford adequate food. We examined whether the experience of each of these hardships occurred within the past three months of the survey, and whether the hardship was reported as a result of the COVID-19 pandemic.

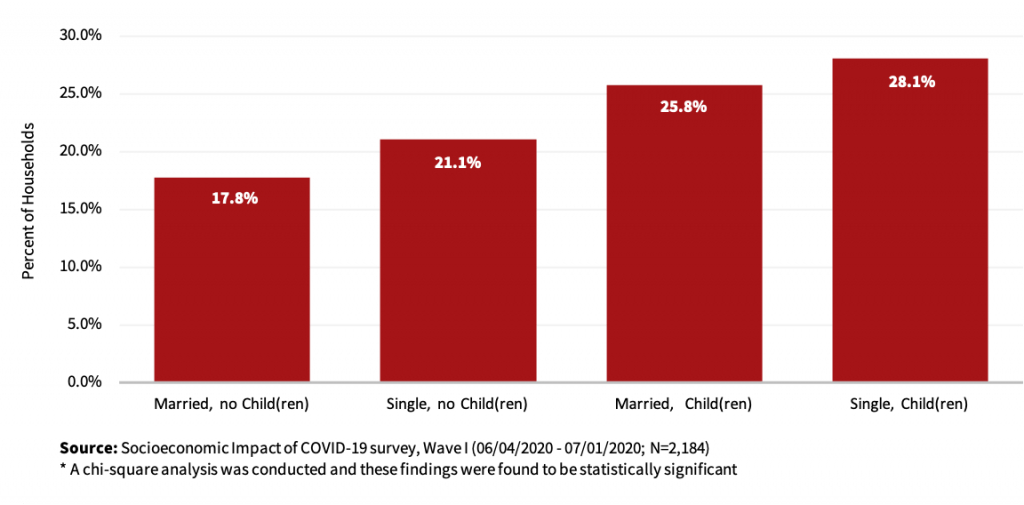

Over a Quarter of Households with Children Reported Bank Account Overdraft

During COVID-19, many respondents indicated overdrafting their accounts, but the differences were significant among those with children in the home. For example, compared to households without children, households with children reported bank account overdraft at higher rates (Figure 1a). There was also a difference between households with married and single respondents—single respondents with children were over 1.5 times more likely to report bank account overdraft, compared to married households without children (Figure 1a).

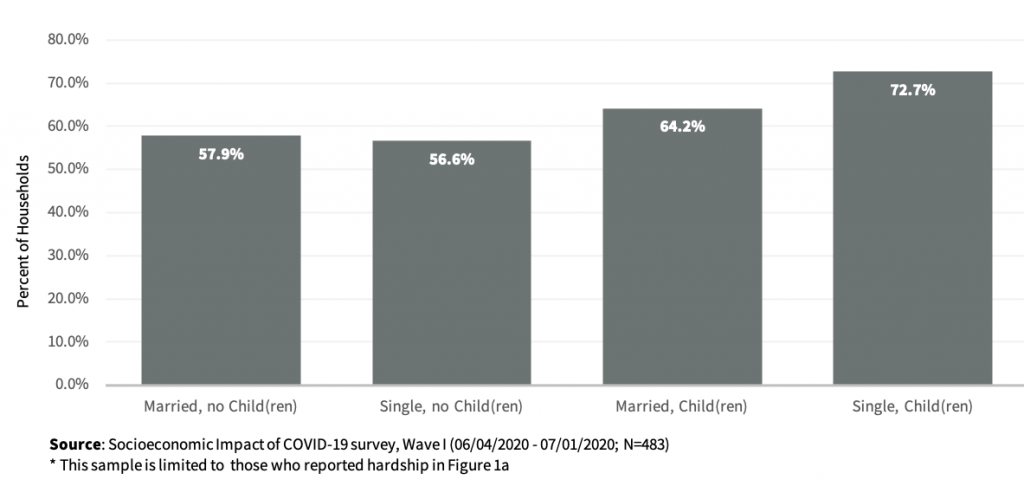

Among those who reported a bank account overdraft in the past three months, most noted the overdraft was due to COVID-19 (Figure 1b), and the rates of bank overdraft due to COVID-19 were similar across different family structures. Together, these findings indicate that single respondents with children were struggling to a greater degree to manage cash flow during the early months COVID-19 pandemic, and most overdrafts occurred to mitigate financial issues caused by the COVID-19 pandemic.

Figure 1a. Bank Account Overdraft, Past 3 Months

Figure 1b. Bank Account Overdraft Due to COVID-19, Past 3 Months

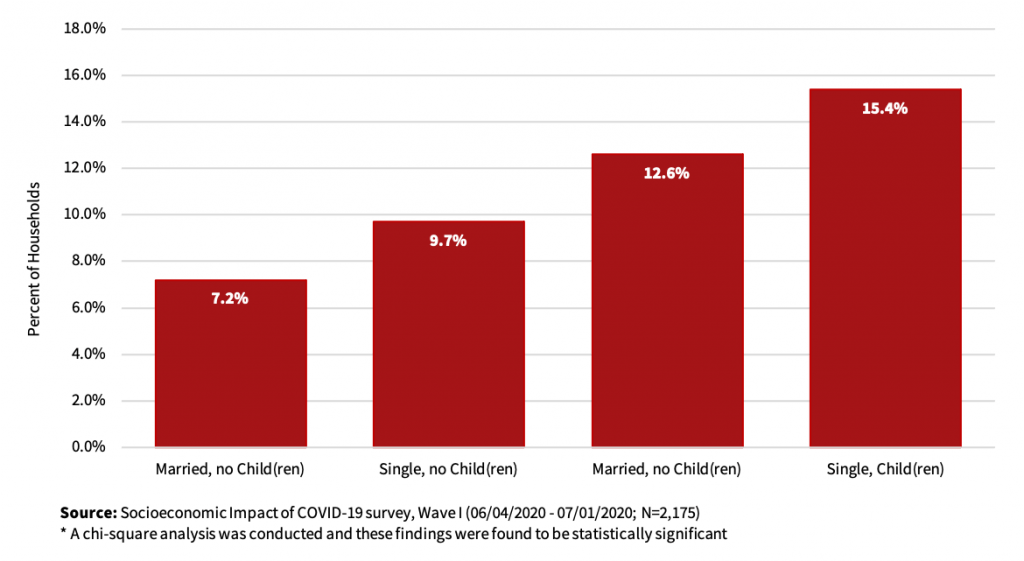

Single Respondents with Children Struggled the Most with Housing Hardship

In addition to overdrafting bank accounts, survey respondents also indicated hardship related to housing. The percentage of households who struggled to pay rent or mortgage within the past three months of the survey was much lower than that reporting a bank account overdraft (Figure 2a). Nevertheless, there were distinct differences in the experience of housing hardship between households with married and single respondents in the early months of the COVID-19 pandemic.

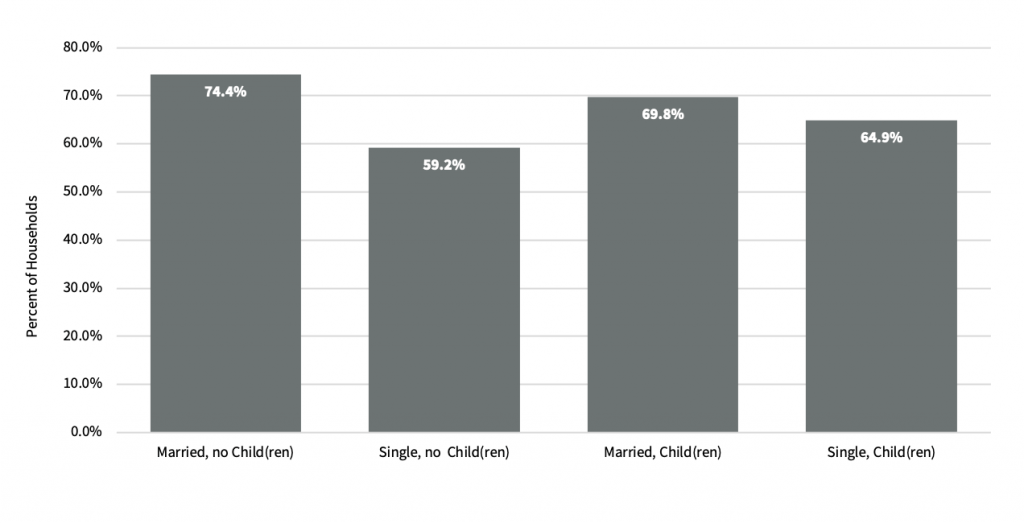

Compared to married households with no children (7.2%), single respondents with children were more than twice as likely to report skipping rent or mortgage (15.4%). Figure 2b shows that among households who struggled to pay rent or mortgage in the past three months of the survey, most reported this being due to COVID-19.

Figure 2a. Skipped Rent or Mortgage Payment, Past 3 Months

Figure 2b. Skipped Rent or Mortgage Payment due to COVID-19, Past 3 Months

Households with Children were Twice as Likely to Report Skipping Bills

Like other forms of material hardship, households with children were more likely to report difficultly paying non-housing bills (Figure 3a). Perhaps most strikingly, households with children were nearly twice as likely to report skipping bills as compared to households without children. Once again, single respondents with children seem to be suffering the most, with more than a quarter of them reporting skipped bills (25.9%). Moreover, the majority of households who reported skipping bills attributed this financial hardship to the COVID-19 pandemic (Figure 3b).

Figure 3a. Skipped Paying Bills, Past 3 Months

Figure 3b. Skipped Paying Bills due to COVID-19, Past 3 Months

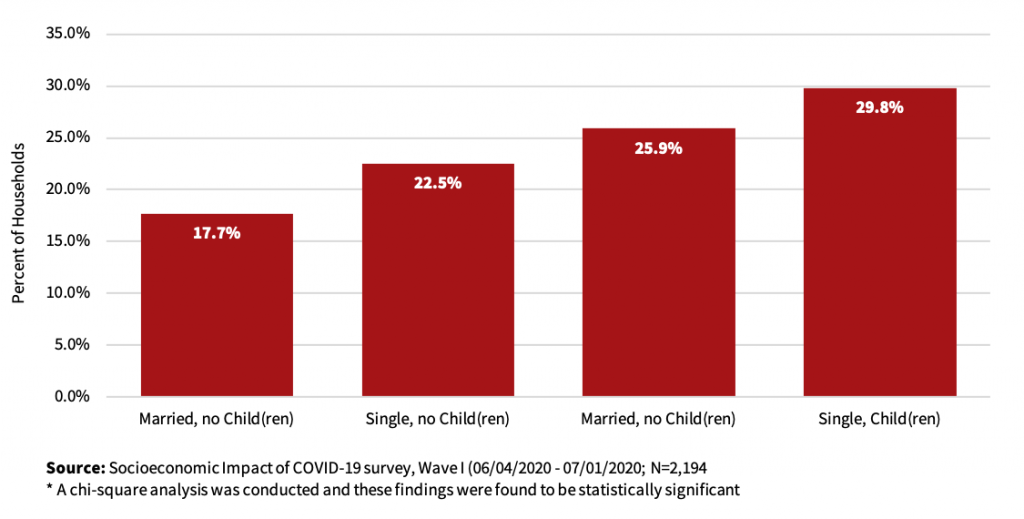

Food Insecurity was the Most Frequently Reported Hardship

Households reported higher rates of being unable to afford adequate amount or quality of food compared to the other forms of material hardship explored in this study. Again, single respondents with children struggled the most during the early months of the COVID-19 pandemic (Figure 4a). Nearly 30% of single respondents with children reported experiencing food insecurity. Of households who experienced food insecurity, the vast majority reported that this was due to COVID-19 (Figure 4b).

Figure 4a. Food Insecurity, Past 3 Months

Figure 4b. Food Insecurity due to COVID-19, Past 3 Months

Israeli Families Need More Support

These results demonstrate the need for policies to support Israeli households with children as they cope with the financial stress caused by the COVID-19 pandemic. Single respondents with children were the most likely to report material hardship, even as the pandemic fell on all types of family structures. While the Israeli government has taken strides to address the financial distress felt by households during the COVID-19 pandemic, more action is needed. Monthly stimulus payments should seriously be considered to mitigate this problem, and the differences in family structure need to be taken into account. Moreover, differences in family structures across religious and ethnic groups should be considered – in a supplemental series of statistical tests, we found that Arab Israelis are more likely than any other religious/ethnic group to report experiencing the types of material hardships mentioned in this study. As such, by providing a financial cushion for families to use during times of crisis, the Israeli government can ensure that Israeli families can work towards building a financially healthy future.