By Dan Zhao, postdoctoral research associate, and Michal Grinstein-Weiss, director

When disaster strikes, it is easy to neglect the people on the boundaries. When assessing the impact of adverse economic shocks, whether it be natural disasters, pandemics, or factory shutoffs, the focal point is on those who were directly devastated by the shock. However, the spillover effect on individuals living next to disasters can be quite consequential. This study aims to explore the mechanisms driving a psychological/informational spillover of major adverse shocks on individual behavior. We start by asking: do individuals change their risk perception and risk preference after a near-miss with a major adverse shock?

A near miss and understanding your risk

To answer this question, we need to consider why people who had near misses with a disaster change their risk perception and preference. It’s human nature to have difficulty with accurately assessing the probability and cost (what we jointly call expected loss) of rare events. For example, since flight accidents always make the headlines, people may wrongly assess the safety of air travel, especially compared with driving.

After personally experiencing a rare adverse shock, people may learn new information from the experience and learn the true risk of a disaster. However, that would only be the case if they do not overestimate the probability of a shock in its aftermath because of a “salience bias.” In this case, the bias suggests that people will believe a disaster might occur more often since they experienced one close to them instead of the true probability of the event occurring. So, our second question is: are we observing individuals understanding the true risk of an event, or is it a behavioral bias such as salience bias?

Assessing risk perception through financial decision making

Researchers often use changes in demand for credit to understand how a person may have changed their risk perception and risk preference. The rationale is that reducing credit demand is a precaution to create a buffer and increase one’s resilience against future financial risks. As for the source of this financial risk, we use natural disasters, in particular, tornadoes. Tornado occurrence is highly random. This means that, in contrast with private financial shocks, the occurrence of a tornado should not do anything to change or inform the real risk of future tornadoes in surrounding areas, as is the case with hurricanes. Hence, we can attribute any behavioral response to near misses with tornadoes to some behavioral (e.g., salience) bias instead of a rational new understanding of risk or risk preference.

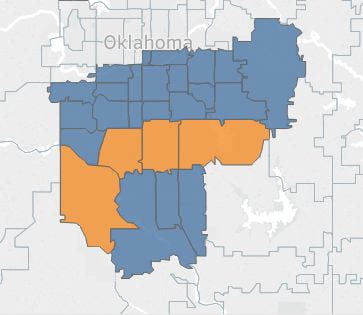

We start by assembling the zip codes and dates associated with each tornado in the United States. The tornado data is then combined with anonymous data on individual credit profiles from Equifax Inc., one of the three major credit bureaus in the United States. The data provides the detailed monthly credit profiles of 21,438,463 random individuals recorded between January 2011 and December 2015. Assuming credit supply remains largely unchanged in the neighbor zones of areas hit by a tornado, which typically has a very limited geographical scope, we use an individual’s debt amount as a proxy for credit demand, which we further use to infer risk perception and attitude.

People on the boundaries changing financial behaviors

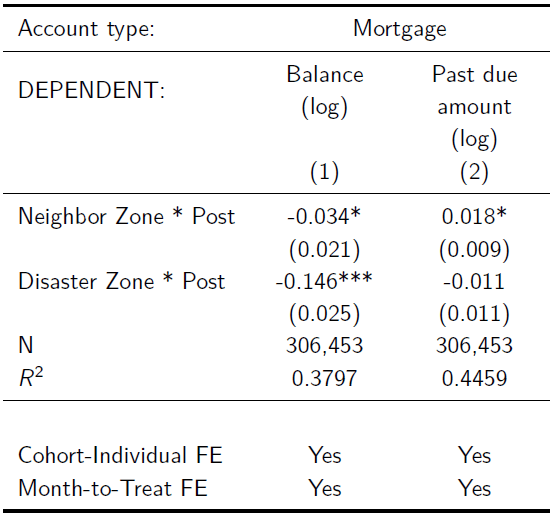

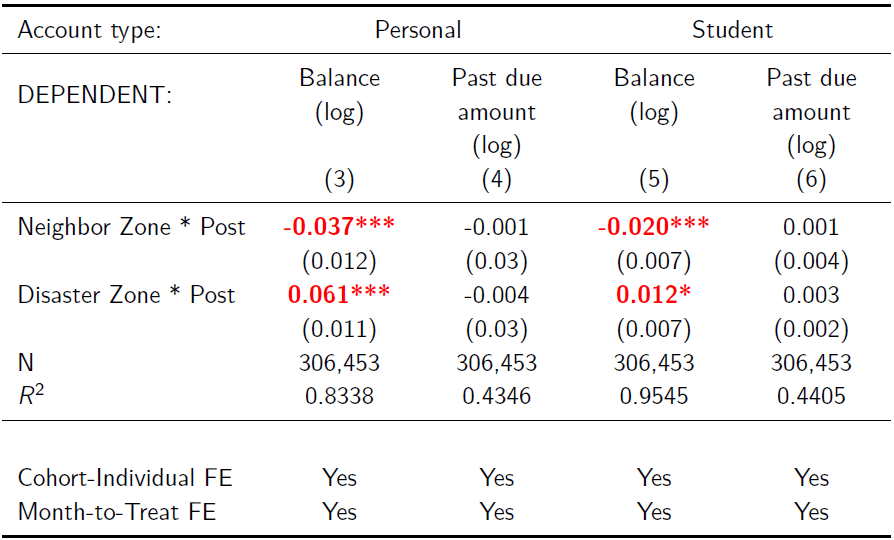

We offer multiple pieces of evidence suggesting that individuals neighboring tornado disaster zones exhibit risk avoidance behavior that is consistent with salience bias, especially from individuals with more financial flexibility. In particular, we find that within one year after a tornado, neighbor zone individuals experience decreases in mortgage (-3.3%), personal (-3.6%), and student loan (-2.0%) balances compared with similar control group individuals in unaffected areas farther away. These decreases are at least partly driven by individuals closing down accounts.

The decrease in mortgage balance by itself may be subject to varied interpretations, including spillover damages from the tornadoes since previous research has shown that homeowners sell properties and use disaster relief funds to pay down mortgages after being hit by a tornado. However, the decreases in other types of debt rule out the possibility that these individuals also suffer from any significant tornado-induced financial strain, either directly or indirectly. This point becomes particularly clear when we compare the neighbor zone findings with that of the disaster zone individuals, who experience substantial mortgage elimination (-13.6%), but increases in personal loan (6.3%) and student loan (1.2%) balances (albeit with a much smaller magnitude). The increases in other types of debt are consistent with the increased spending needs and financial strain caused by tornado damages. A back-of-the-envelope calculation combining the numbers above and the relative sample size of neighbor vs. disaster zones shows that the aggregate spillover effect relative to direct impact is roughly 49% for mortgages, 115% for personal loans, and 336% for student loans.

Does a near-miss with disaster change your understanding of risk?

Next, we investigate whether the neighbor zone results are driven by learning about the true risk of an event or salience bias. First, since tornado occurrence is completely random and its cost is public information, near misses should not rationally lead to a reassessment of disaster risk. Hence, salience bias is more likely than rational risk assessing. Second, we support this argument by exploring the varying treatment effects based on individual financial flexibility before the tornado. The rationale is as follows: individuals with more financial flexibility are better guarded against disaster fallout and should be less concerned about such risks. Therefore, they should respond less strongly to such a near-miss than other individuals. On the other hand, if the results are driven by some behavioral bias, it might be magnified by increased financial flexibility and hence leeway to have a financial reaction. Simply put, a person reacts more because she can.

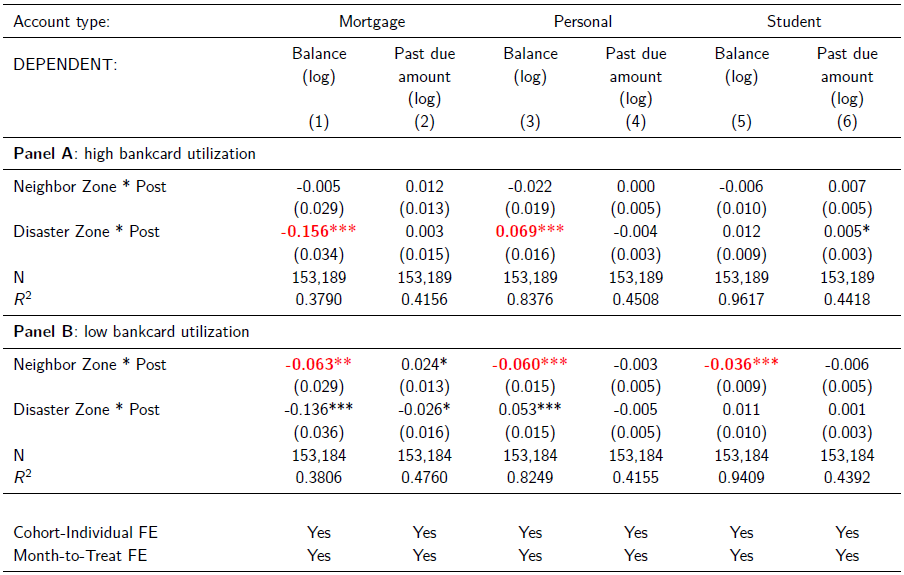

To see which case it is, we conduct a subgroup analysis based on bank card utilization rate (balance divided by credit limit). The results show that while the financial reaction among disaster zone individuals is generally stronger among individuals who have higher bank card utilization rates and are thus more financially constrained, the financial reaction among neighbor zone individuals is greater among individuals who have lower utilization rates and therefore have more financial flexibility. Among the lucky individuals who barely dodged a tornado, those who are more financially secure seem to be even more worried about future encounters than vulnerable groups in more precarious financial conditions. In particular, neighbor zone individuals in the low bank card utilization subgroup experienced statistically significant decreases in mortgage (6.5%), personal loan (6.2%), and student loan (3.7%) balances, but none of these balances show significant changes in the high bank card utilization subgroup.

Recovering from disaster includes individuals within the boundaries

The findings of our paper contribute to our understanding of the aggregate repercussions of major adverse shocks by highlighting a psychological spillover effect that is often neglected. They also imply that studies using neighboring areas as control groups for a shock may misestimate the magnitude of the shock. Our findings will inform future policymaking in response to all types of natural disasters such as hurricanes, floods, wildfires, or even pandemics, in that disaster relief needs to account for neighboring areas. Finally, they may inform fairer and more accurate scoring of credit risks for individuals affected by rare events.

This blog is based on a current working paper: Do near misses with a disaster affect individual demand for credit? A large-scale study of credit profiles.